FINTECH FOR VIKSIT BHARAT

The Bharat Fintech Summit is a premier industry event that brings together key stakeholders in the BFSI sector, including regulators, innovators, investors, and technology providers, to facilitate meaningful discussions on digital transformation and its implications for the industry. The two-day conclave serves as a platform for knowledge sharing, collaboration, and collective wisdom with the overarching goal of driving innovation and advancing digitization to ensure the widespread availability of financial services across all segments of society.

With a focus on empowering participants with valuable insights and fostering partnerships, the summit seeks to cultivate a supportive ecosystem for the development and dissemination of financial solutions that can reach even the most remote areas. By promoting a knowledge-driven approach and encouraging industry-wide transformations, the Bharat Fintech Summit is a pivotal event for the advancement of the Indian fintech landscape.

This year’s Bharat Fintech Summit, with the theme “Future Ready Banking for Viksit Bharat,” centers on the vision of a digitally empowered India. The theme reflects the event’s focus on fostering innovation and discussions around the future of digital finance, aiming to drive financial inclusion and facilitate the widespread adoption of digital solutions across the nation.

By emphasizing the importance of “Viksit Bharat,” or a developed India, the summit seeks to explore the role of fintech in promoting economic growth and social development. It serves as a platform for industry stakeholders to share insights, collaborate, and address the challenges and opportunities associated with the digital transformation of the BFSI sector.

Through panel discussions, workshops, and networking events, the Bharat Fintech Summit 2025 aims to contribute to the realization of a future-ready banking landscape that can support the aspirations of a rapidly evolving India.

Shri Manish Bhardwaj, Deputy Director General of the Unique Identification Authority of India (UIDAI), delivered a pivotal keynote at the Bharat Fintech Summit 2025, outlining transformative developments in India’s digital identity ecosystem. His address emphasized Aadhaar’s evolving role as a foundational pillar for financial inclusion, secure authentication, and private-sector innovation. Below is a comprehensive analysis of his key announcements and insights.

Mr. Bharadwaj announced at the 3rd Edition of the Bharat Fintech Summit 2025 that non-government entities would be permitted to request Aadhaar authentication starting January 31, 2025, with the aim of promoting good governance and ease of doing business.With over 250 successful use cases already recorded, the Unique Identification Authority of India (UIDAI) is preparing to launch a dedicated portal for the onboarding of non-governmental entities seeking Aadhaar Authentication Services.

This move is expected to streamline the process for private organizations to integrate Aadhaar authentication into their services, spanning various sectors such as eCommerce, travel, tourism, and more. By opening up Aadhaar authentication to the private sector, the government aims to enable businesses to offer more efficient and secure services to citizens, ultimately enhancing the overall digital experience for all.

“The ambit of KYC has been opened and in the coming months we will see many use cases emerge, especially in sectors such as travel and tourism, transport, entertainment, healthcare and employment services. E-commerce entities can come in, credit rating bureaus and agencies can benefit from this,” said Mr Bhardwaj.

Expansion of Aadhaar Authentication to Private Entities

Under the Aadhaar Authentication for Good Governance (Social Welfare, Innovation, Knowledge) Rules, 2020, the central government has authorized private entities-including fintechs, e-commerce platforms, telecom providers, and credit bureaus-to integrate Aadhaar authentication into their services. This regulatory shift aims to enhance service delivery, reduce fraud, and streamline customer onboarding by leveraging Aadhaar’s secure biometric infrastructure. Bhardwaj highlighted that this move aligns with the broader vision of enabling “ease of living” for residents while ensuring robust governance frameworks.

The initiative is expected to catalyze innovation across sectors, particularly in Banking, Financial Services, and Insurance (BFSI), where seamless KYC (Know Your Customer) processes are critical. Private entities can now verify specific user attributes through customized e-KYC solutions, reducing onboarding friction and operational costs.

—Revolutionizing KYC with AI-Driven Face Authentication

Bhardwaj announced the widespread success of Aadhaar’s face authentication technology, which has processed over 103 crore transactions since its inception. This contactless method, compatible with Android and iOS devices, allows users to complete KYC verification remotely using their smartphone cameras. Key advancements include:

– AI-Powered Liveness Detection: Prevents spoofing attempts by analyzing real-time biometric data.

– Real-Time Mobile Number Updates: Customers can now update their mobile numbers linked to Aadhaar directly via customer-facing apps, enhancing accessibility.

– Scalability: Over 95 BFSI entities, including banks and NBFCs, have adopted face authentication, with daily transactions projected to reach 5–6 crore.

This technology has significantly reduced dependency on physical documents and specialized biometric devices, democratizing access to financial services.

Aadhaar’s Role in Financial Inclusion and Digital Transformation

Bhardwaj underscored Aadhaar’s foundational impact on India’s digital economy, citing the issuance of 141 crore Aadhaar IDs and the processing of 14,000 crore authentication transactions to date.

These milestones have enabled:

– Jan Dhan Accounts: Over 500 million bank accounts opened for underserved populations, facilitated by Aadhaar-based e-KYC.

– Unified Payments Interface (UPI): Seamless integration with Aadhaar authentication has driven UPI’s adoption, which now handles over 100 billion transactions monthly.

– India Stack: Aadhaar forms the backbone of this digital public infrastructure, supporting services ranging from direct benefit transfers to digital lending. The India Stack has positioned the country as a global leader in digital governance, with its open APIs fostering innovation in fintech and beyond.

Future Roadmap:

Customized Solutions and Cross-Sector Integration

Looking ahead, UIDAI plans to launch a dedicated authentication portal for private entities, enabling tailored solutions for industries like e-commerce, travel, and digital lockers. Bhardwaj also emphasized collaborations to integrate Aadhaar with emerging technologies, such as:

– Risk-Based Lending: Using Aadhaar data to assess creditworthiness for underserved segments. – Travel and Healthcare: Exploring partnerships to enable Aadhaar-based check-ins and medical record access.

– Fraud Prevention: Enhancing cybersecurity through real-time authentication and AI-driven anomaly detection.

Economic and Regulatory Implications

The expansion of Aadhaar authentication to the private sector is poised to unlock significant economic value. By reducing onboarding costs and fraud risks, businesses can scale operations efficiently while complying with RBI regulations. Bhardwaj noted that this initiative aligns with the government’s vision of a $30 trillion economy by 2047, driven by digital innovation and financial inclusion. However, he also cautioned about the need for vigilant data governance. UIDAI’s in-house AI/ML frameworks ensure that authentication data remains encrypted and inaccessible to third parties, addressing privacy concerns.

Shri Manish Bhardwaj’s address at the Bharat Fintech Summit 2025 reaffirmed Aadhaar’s centrality to India’s digital future. By opening authentication to private entities, advancing face recognition technology, and fostering cross-sector collaboration, UIDAI is paving the way for a more inclusive and secure digital economy. These developments not only enhance service delivery but also position India as a global benchmark for leveraging digital identity to drive socioeconomic progress. As Bhardwaj concluded, “Aadhaar’s journey from a welfare enabler to a growth accelerator exemplifies India’s ability to innovate at scale.”

The fireside chat between Dilip Asbe (MD & CEO of National Payments Corporation of India) and Sameer Singh Jaini (Founder & CEO of The Digital Fifth) offers valuable insights into India’s digital payments ecosystem. This discussion explores how industry leaders are ensuring safety, trust, and financial inclusion while highlighting the remarkable growth trajectory of UPI (Unified Payments Interface) and its impact on the Indian economy.

Growth of UPI & Digital Payments in India

UPI has witnessed phenomenal growth in India, with Asbe highlighting NPCI’s vision of scaling to 100 billion transactions per month. This ambitious target builds on UPI’s current success, where it recorded a record high of ₹24.77 lakh crore (approximately $24.8 trillion) in transactions during March 2025, marking a 25% increase in value and an impressive 36% growth in volume compared to the previous year. Despite a slight 2% dip to 17.89 billion transactions in April 2025, the long-term growth trajectory remains strong with daily UPI transactions reaching 596 million in April.

The consistent growth reinforces UPI’s position as a cornerstone of India’s payment infrastructure, with Asbe emphasizing that this growth journey is just beginning. The technology has created an asset-light, context-driven digital payments layer that forms the infrastructure for all financial services in India. This digital-first approach has revolutionized how payments are envisioned not just domestically but potentially on a global scale as well.

Economic Impact of Digital Payments

The economic impact of UPI extends far beyond mere transaction numbers. As Asbe explains in the fireside chat, UPI has transformed financial inclusion, MSME credit access, and tax collections across India. By solving two major problems for service companies-user onboarding and payment collection-UPI has created a layer that makes competition easier and ultimately benefits citizens through better services at lower costs.

Digital payments have significantly contributed to the formalization of the Indian economy through increased financial inclusion while creating market opportunities for entrepreneurship, as evidenced by the growing startup ecosystem. The benefits include increased velocity of money, enhanced tax collection, and greater economic formalization. For micro-merchants and SMEs who were previously dependent on cash, UPI has enabled them to collect payments digitally, especially following demonetization and accelerated adoption during the COVID-19 pandemic.

Furthermore, as pointed out in the discussion, “digital payments are helping the growth of other industry sectors (both B2B and B2C) by eliminating the challenges involved in cash transactions. This has made it easier and faster to realise the transactions in the recipient’s financial books”

Fraud Prevention & Consumer Trust

A central theme of the fireside chat was building consumer trust in digital payments. Asbe emphasized that “a payment system is as good as trust,” highlighting three paramount areas for creating trust: education and awareness, technology use, and a strong legal framework.

With UPI expanding to include 450 million users and targeting the next 200-250 million smartphone users plus 300 million feature phone users, Asbe stressed that these new adopters would be more vulnerable, requiring significant education and awareness efforts. NPCI has launched campaigns featuring public figures to warn against investment scams, fake arrest scams, and other digital fraud threats.

RBI’s Role & Regulations

The regulatory framework established by the Reserve Bank of India plays a crucial role in the sustainable growth of digital payments. In the fireside chat, Asbe discussed the importance of a sustainable digital payment model and the push for MDR (Merchant Discount Rate) incentives.

As Asbe said in the discussion: “There has to be economic incentive for the ecosystem to invest and grow… the whole ecosystem needs investment”. The conversation highlighted that NPCI and industry forums continue to work with regulators and the government to create reasonable economic incentives for market expansion.

Cross-Border UPI Expansion

The fireside chat highlighted NPCI’s international ambitions for UPI. Through its international subsidiary NPCI International Payments Limited (NIPL), UPI is being expanded globally to enable real-time international transactions.

Currently, UPI payments are accepted in seven countries: Bhutan, Mauritius, Nepal, Singapore, Sri Lanka, and France. In a significant development, NIPL announced plans to expand UPI to 4-6 additional countries by 2025, focusing on destinations popular with Indian tourists, including Qatar, Thailand, and parts of Southeast Asia.

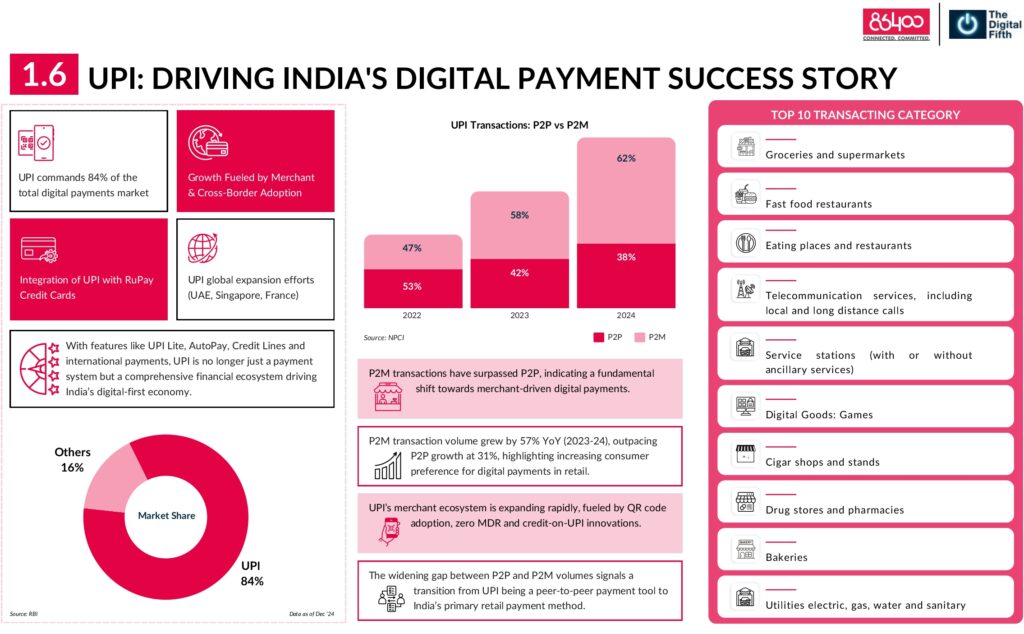

India’s digital payments landscape has experienced a significant transformation, driven primarily by the Unified Payments Interface (UPI). Initially designed for peer-to-peer money transfers, UPI has evolved into the backbone of India’s financial ecosystem, supporting various services such as merchant transactions, embedded finance, and cross-border payments.

As of 2024, UPI accounts for more than 84% of all digital transactions in India. With a projected growth from 16 billion monthly transactions in December 2024 to 54 billion by 2030, UPI’s influence in the financial sector is poised to expand even further.

This remarkable growth highlights the increasing adoption of digital payments in India and signifies the success of initiatives aimed at fostering financial inclusion and a cashless economy. As UPI continues to grow and evolve, it will play an even more crucial role in shaping the future of India’s digital financial landscape.

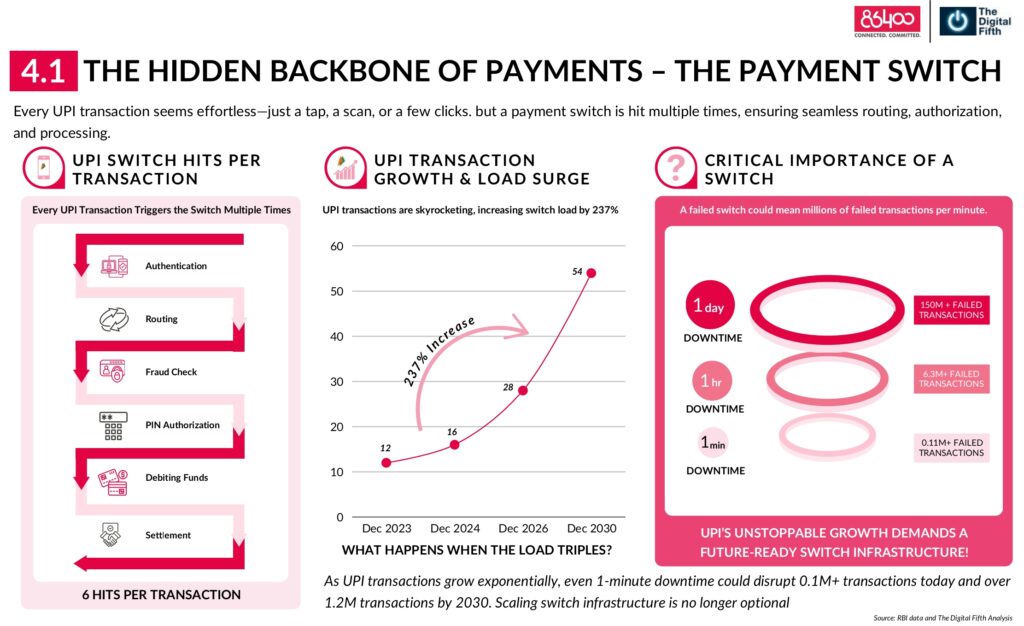

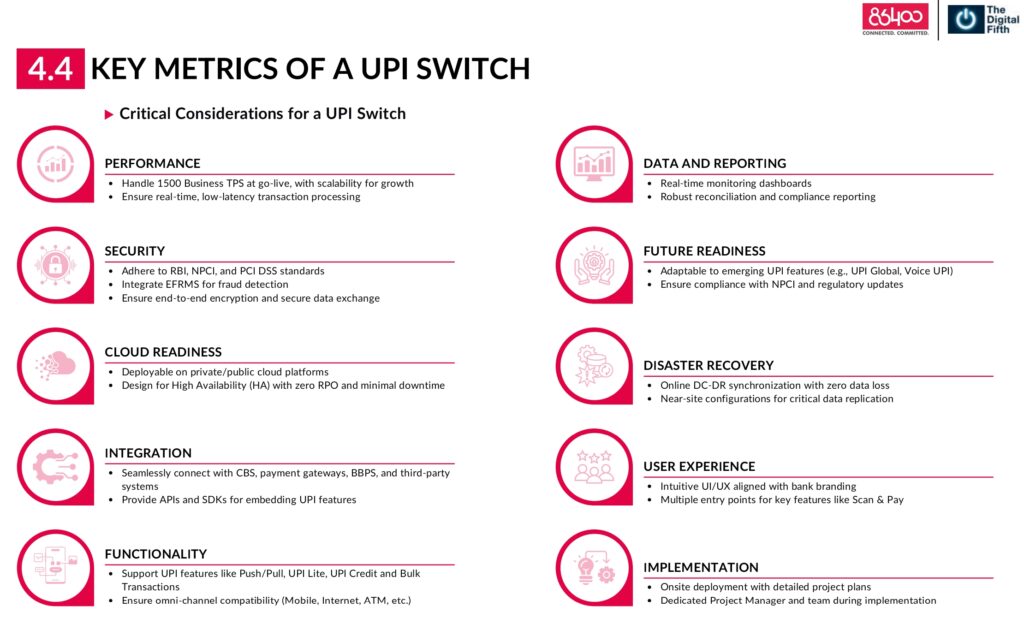

While UPI has undoubtedly revolutionized digital payments in India, the future of this ecosystem depends on robust, scalable, and secure infrastructure to support its rapid growth. As transaction volumes continue to surge, it is crucial to prioritize seamless interoperability, real-time fraud detection, and resilient systems to ensure zero downtime.Innovations such as resilient and scalable switches, as well as mandatory two-factor authentication, are critical components that will help maintain the integrity and security of the digital payments landscape.

Advanced switching technology lies at the heart of this transformation, as it facilitates the various interactions involved in every UPI transaction, including authentication, routing, authorization, and fraud checks.

As UPI expands to handle billions of transactions each month, the implementation of dual-core switches and cloud-native architecture is essential to achieve high availability and zero downtime. Future-ready switch infrastructure will act as the backbone of India’s payment ecosystem, providing the necessary support for exponential growth without compromising speed or security. By embracing these advancements, India can sustain its position as a global leader in digital payments and pave the way for continued innovation in the fintech sector.