INDIA AI RESPONSIBLE FINTECH

The Global Fintech Fest (GFF) is a highly esteemed annual fintech conference organized by the Payments Council of India (PCI), the National Payments Corporation of India (NPCI), and the Fintech Convergence Council (FCC). The conference serves as a thought leadership platform, promoting collaboration and innovation within the global fintech community. Global Fintech Fest (GFF) 2024 is presented by the Ministry of Electronics and Information Technology (MeitY), Ministry of External Affairs, Department of Financial Services (DFS), Reserve Bank of India (RBI) and International Financial Services CentresAuthority (IFSCA).

The 5th edition of GFF, held in Mumbai from August 28th to 30th, 2024, saw a significant expansion with the theme “Blueprint for the Next Decade of Finance: Responsible AI, Inclusive, Resilient.” With the current world facing socio-political tensions, economic uncertainties, and rapid technological advancements, the conference emphasized the importance of building an ethical, inclusive, and resilient financial ecosystem.

GFF 2024 attracted a lineup of over 800 distinguished speakers, comprising policymakers, regulators, and fintech founders from around the globe. These industry leaders participated in more than 300 engaging sessions, highlighting cutting-edge technologies, innovative solutions, and emerging trends within the fintech sector.

The conference offered attendees a comprehensive outlook on the future of the fintech industry, providing opportunities for networking, knowledge sharing, and exploring potential collaborations. The Global Fintech Fest continues to play a pivotal role in shaping the fintech landscape, fostering growth and innovation within the sector.

The Global Fintech Fest (GFF) stands out as more than just a large-scale conference; it serves as a powerful catalyst for transformation within the fintech ecosystem. Offering a diverse range of sessions, including keynotes, panel discussions, fireside chats, roundtables, and networking opportunities, GFF cultivates a dynamic environment for collaboration, innovation, and knowledge sharing among industry leaders, experts, and enthusiasts.

By providing a platform for showcasing groundbreaking fintech advancements at an extensive expo, GFF not only highlights the latest industry developments but also facilitates investment pitches, workshops, and hackathons to drive impactful conversations and actionable insights within the fintech community.

Through its comprehensive approach, GFF fosters meaningful connections, encourages co-creation, and inspires forward-thinking strategies that propel the fintech industry towards a more inclusive, resilient, and responsible future. Ultimately, the Global Fintech Fest stands as a testament to the power of collaboration and innovation in shaping the next decade of finance.

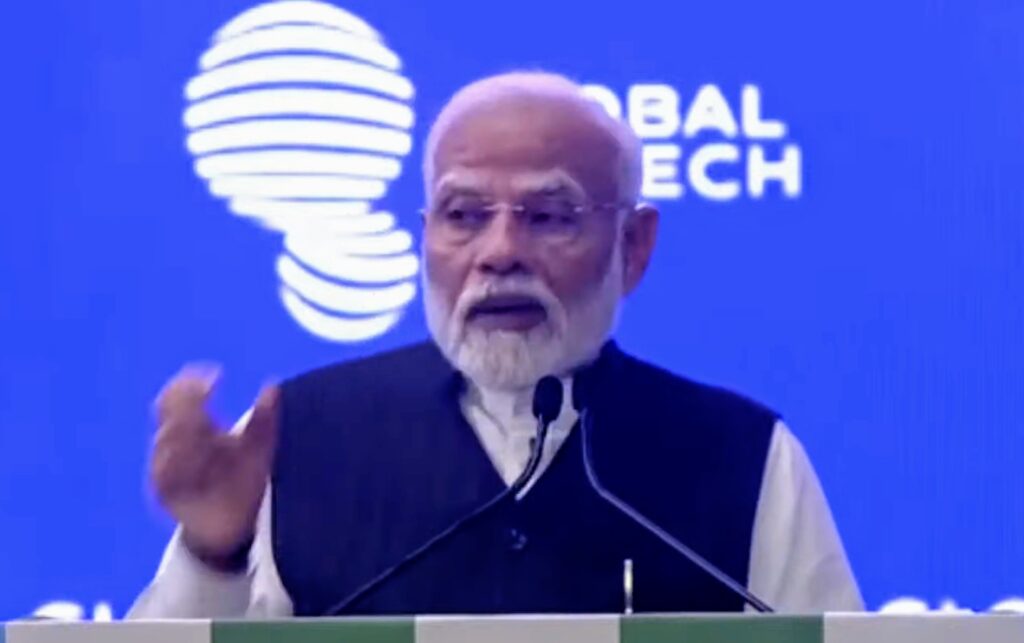

Prime Minister Narendra Modi delivered a significant address at the Global Fintech Fest 2024, held from August 28-30, 2024, at the Jio World Convention Centre in Mumbai. His speech highlighted India’s fintech progress and outlined future directions for the sector. Here’s a comprehensive summary of the key points from his address.

“Cheap phones, cheap data, and zero balance Jan Dhan accounts have done miracles in India,” he proclaimed.

India’s Fintech Revolution and Growth

Unprecedented Growth and InvestmentPrime Minister Modi highlighted the remarkable growth of India’s fintech sector, emphasizing that the industry has attracted over USD 31 billion in investment over the past decade with a staggering 500% increase in fintech startups. This growth has positioned India as a global leader in financial technology innovation.

Digital Infrastructure Expansion

A foundational element of India’s fintech success has been its rapidly expanding digital infrastructure. PM Modi noted that broadband users in India have increased from 60 million to approximately 940 million in just one decade. This digital connectivity has been crucial for the widespread adoption of fintech solutions across the country.

Banking Accessibility and Financial Inclusion.

The Prime Minister emphasized that over 530 million people now have Jan Dhan accounts, effectively connecting a population equivalent to the entire European Union to the formal banking system in just 10 years. This achievement represents a significant milestone in India’s journey toward financial inclusion.

“There was a time when foreigners were taken aback by the cultural diversity of India. Now they are taken aback by India’s fintech diversity. People are able to benefit from becoming a part of the formal economy”.

The JAM Trinity and Digital Payments

Jan Dhan, Aadhaar, and Mobile (JAM)Modi highlighted how the trinity of Jan Dhan accounts, Aadhaar identity, and mobile connectivity has transformed India’s economy. This foundation has enabled nearly half of the world’s real-time digital transactions to take place in India.

UPI Success Story

India’s Unified Payments Interface (UPI) was showcased as a prime example of the country’s fintech achievement, demonstrating how local innovations can have global applications. The Prime Minister noted that UPI has enabled 24/7 banking services regardless of location or weather conditions.

Pandemic Resilience

PM Modi pointed out that during the COVID-19 pandemic, India was among the few countries where banking services continued uninterrupted, highlighting the robustness of its digital financial ecosystem.

Women Empowerment Through Fintech

Jan Dhan Impact on Women

The 10-year milestone of Jan Dhan Yojana was highlighted as a significant achievement for women’s financial empowerment, with over 29 crore bank accounts opened for women. These accounts have created new opportunities for savings and investments.

Mudra Yojana Benefits

Modi noted that the Mudra Yojana, built on the philosophy of Jan Dhan accounts, has disbursed credit worth Rs 27 trillion, with approximately 70% of beneficiaries being women. This has significantly contributed to women’s economic participation and independence.

Social Impact and Democratization of Finance

Bridging Urban-Rural Divide

The Prime Minister emphasized that fintech has helped bridge the gap between urban and rural India, making financial services accessible to previously underserved populations. What once took an entire day for farmers, fishermen, and middle-class families is now available instantly on mobile devices.

Democratizing Financial Services

Fintech has played a crucial role in democratizing access to loans, credit cards, investments, and insurance products. Modi specifically mentioned how street vendors can now avail collateral-free loans through the PM SVANidhi scheme, enabling them to expand their businesses through digital transactions.

Innovation and Future Technologies

Emerging Technologies

PM Modi highlighted how technologies like Digital Twins are taking data-based banking to the next level, potentially transforming risk management, fraud detection, and customer experience. He also mentioned the Open Network for Digital Commerce (ONDC) making online shopping more inclusive.

Global Application of Local Solutions

The Prime Minister emphasized that India is creating products that are “local in nature but global in application”. He mentioned innovations like account aggregators, trade platforms, and e-RUPI digital vouchers that have potential applications worldwide.

Policy Support and Regulatory Challenges

Government Initiatives

Modi highlighted several government actions to support the fintech sector, including the abolition of Angel Tax, allocation of Rs 1 lakh crore for research and innovation, and implementation of the Digital Personal Data Protection Act.

Cyber Security Concerns

The Prime Minister expressed concern about cyber fraud and emphasized the need for regulators to take significant steps to enhance digital literacy and cybersecurity. He noted that cyber fraud could impede the growth of startups and fintech if not addressed properly.

Future Outlook

Sustainable Economic Growth

PM Modi identified sustainable economic growth as India’s priority, with efforts to create robust, transparent, and efficient systems to strengthen financial markets.

Global Impact

The Prime Minister concluded with confidence that India’s fintech ecosystem will enhance the ease of living not just for Indians but for the entire world, stating “Our best is yet to come”.

Modi’s speech at the Global Fintech Fest 2024 demonstrates India’s commitment to leading global fintech innovation while addressing the challenges of inclusive growth, cybersecurity, and sustainable development in the digital financial ecosystem.

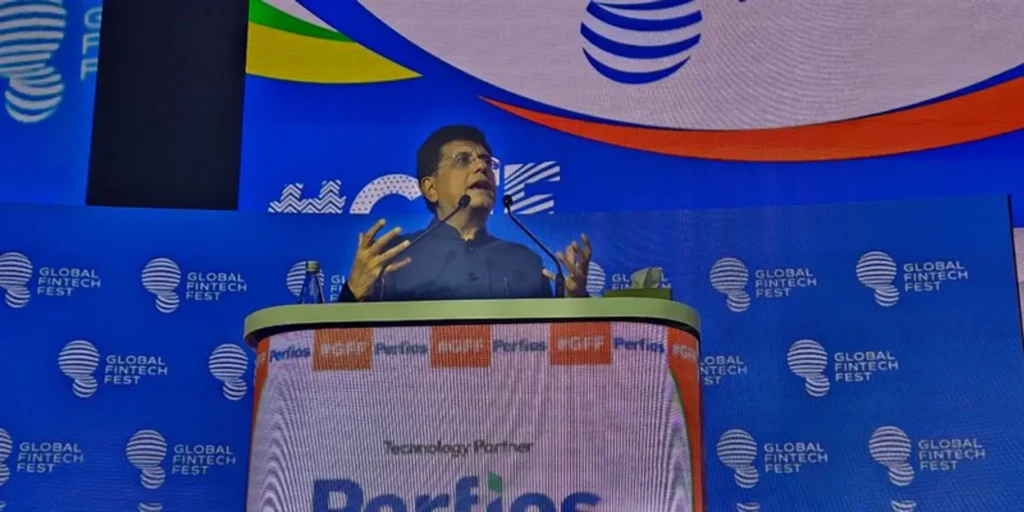

During the occasion, Union Minister Shri Piyush Goyal expressed pride in India’s flourishing fintech sector, highlighting its rapid growth and ability to innovate. He commended the professionals in the fintech industry for creating new avenues and breaking entry barriers that had previously hindered access to banking and financial services for a significant portion of the Indian population.

Shri Goyal praised the sector for its resilience and perseverance, acknowledging that its innovative spirit and unwavering commitment have played a crucial role in powering the economy through challenging times. He emphasized the need for the fintech sector to prioritize ethical AI practices while seeking innovative solutions to combat money laundering and financial crimes.

The Union Minister’s remarks underlined the government’s appreciation for the fintech industry’s contributions and its potential to drive positive change in India’s financial landscape. By championing the responsible development and application of AI, Shri Goyal urged the sector to continue fostering a robust, inclusive, and secure financial ecosystem for all.

Union Minister of Commerce and Industry, Piyush Goyal, lauded the fintech sector’s unwavering commitment to driving financial inclusion in India through relentless innovation and creativity. Speaking at the Global Fintech Fest (GFF) in Mumbai, Goyal highlighted the sector’s ability to empower previously underserved populations by breaking down barriers to entry and facilitating greater access to financial services.

Piyush Goyal Commerce and Industry Minister Piyush Goyal suggested the fintech players speak more openly about India’s success in the fintech space. Union Minister of Commerce and Industry Piyush Goyal praised the fintech sector’s passion and innovation in accelerating financial inclusion in the country. “Today, every willing adult proudly has a bank account of their own. They are able to transact using their bank account; poor and less privileged sections of society who are beneficiaries of the government’s affirmative action are able to receive money from the government without any middlemen, without any corruption through a completely honest and transparent mechanism,” Goyal said.

The Minister acknowledged that the fintech industry’s resilience and ingenuity have not only contributed to the country’s economic growth, but also played a crucial role in revolutionizing India’s financial landscape. He emphasized the importance of ethical AI practices within the sector and encouraged fintech players to develop innovative solutions for combating money laundering and financial crimes.

“Our success story needs to be told across the world,” he said. “I urge one of you who are able to travel and interact at different forums internationally to please take some literature and keep yourself up to date with all that is happening in the great India fintech story and take the message across the world.” Said Goyal.

Goyal’s remarks reflected the government’s appreciation of the fintech sector’s achievements and its potential to drive positive change in the country’s financial ecosystem. By fostering an environment of collaboration and promoting ethical AI use, the Minister urged the industry to continue pushing boundaries and advancing inclusive, responsible financial solutions.

Union Minister Piyush Goyal acknowledged the transformative impact of the fintech sector in revolutionizing the financial landscape and extending essential financial services to the most underserved populations across the country. Goyal praised the sector’s rapid evolution, which has enabled it to reach even the remotest corners of India, ensuring that the benefits of financial inclusion and economic growth are experienced by all citizens, especially those at the bottom of the pyramid.

“A lot of India’s economic success rests on the shoulders of the fintech sector, especially during the pandemic, wherein innovations by the sector aided the economy then,” the Union Commerce and Industry Minister said.

The Minister emphasized that fintech’s ability to overcome barriers and extend financial services to those who previously lacked access has been instrumental in driving social and economic progress. By fostering innovation and resilience, the sector has not only bolstered India’s economic growth but also played a crucial role in empowering people in every corner of the nation.

Union Minister Piyush Goyal expressed high expectations for the Global Fintech Fest (GFF), predicting it would soon become the world’s largest fintech event. He acknowledged the significant contributions of the fintech sector in meeting industry expectations and pushing boundaries through innovation. Goyal commended the sector’s professionals, stating that their commitment to staying abreast of cutting-edge technologies has enabled India to compete on a global scale.

Goyal highlighted that despite being a developing nation not yet fully integrated with advanced technological systems, India has been able to create low-cost and efficient fintech solutions that have garnered international admiration. While other countries may have invested billions of dollars, India’s success story stems from the collaborative efforts of professionals in finance, software, and other sectors, who together have built a fintech ecosystem that is now recognized as a “phenomenal success story.”

The Minister’s remarks emphasized the immense potential and impact of India’s fintech sector in driving economic growth and transforming the global financial landscape. By continuing to foster innovation and collaboration, the sector has the potential to set new benchmarks for inclusive, responsible, and cutting-edge fintech solutions.

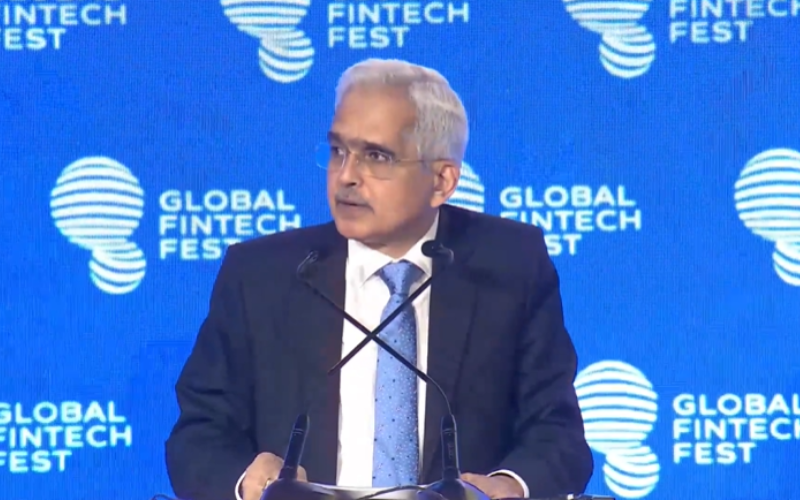

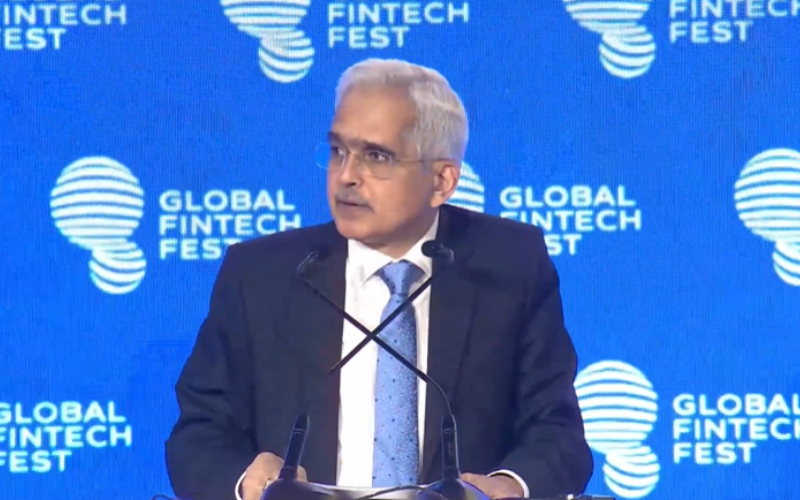

In his keynote address at the Global Fintech Festival, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasized the profound impact of fintech on the traditional financial services landscape. He discussed how fintech has brought about significant changes in the way financial services are delivered and consumed, paving the way for greater innovation and financial inclusion.

“We are on the cusp of a major transformation in the fintech sector not only in India but many other countries as well. This transformation has significantly impacted delivery of financial services by making them faster, cheaper, efficient and more accessible, Das said.

Governor Das highlighted the RBI’s role in promoting fintech innovation and ensuring that it benefits the broader economy. He outlined several initiatives the central bank has undertaken in collaboration with the government and industry stakeholders to foster a conducive environment for fintech growth. These efforts include regulatory sandboxes, innovation hubs, and guidelines to encourage responsible innovation.

Additionally, the RBI Governor stressed the importance of an effective self-regulatory structure within the fintech industry. He urged fintech players to establish a Self-Regulatory Organization (SRO) to promote industry best practices, data protection norms, and ethical business practices. This would help ensure good governance and maintain public trust in fintech services.

Overall, Governor Shaktikanta Das’s keynote address at the Global Fintech Festival underscored the RBI’s commitment to fostering a robust and inclusive fintech ecosystem in India, while emphasizing the importance of responsible innovation and self-regulation within the industry.

Reserve Bank of India (RBI) Governor Shaktikanta Das commended India’s approach to digitization, which focuses on creating digital public infrastructure (DPIs) that promote interoperability, openness, and inclusion. This model has proven successful in delivering essential services to the people, as it allows the private sector to build innovative products on top of the established DPI foundation.

One prime example of a DPI in India’s fintech revolution is the Unified Payments Interface (UPI). Launched just seven years ago, UPI has played a pivotal role in enabling secure and instant money transfers. The platform’s remarkable success has made it a global success story, and its widespread adoption has contributed significantly to the country’s rapid digital transformation.

Governor Das acknowledged the collaborative efforts of the government and private sector in driving India’s fintech revolution. By leveraging DPIs like UPI, the country has successfully fostered a vibrant and inclusive digital financial ecosystem, setting a benchmark for other nations to follow.

RBI Governor Shaktikanta Das outlined the various institutional arrangements implemented by the Reserve Bank of India (RBI) to fuel innovation in the fintech sector while maintaining stability, transparency, and fair practices in the financial ecosystem. These initiatives include setting up the Institute for Development and Research in Banking Technology (IDRBT), National Payments Corporation of India (NPCI), Indian Financial Technology & Allied Service (IFTAS), Reserve Bank Information Technology Pvt. Ltd. (ReBIT), Reserve Bank Innovation Hub, and the Department of Fintech within the RBI.

These institutions, along with appropriate policy initiatives, play a vital role in shaping the development of the fintech sector in India. The RBI aims to strike a balance between promoting a conducive environment for innovation and ensuring the security and stability of financial services. By fostering collaboration between regulatory bodies, industry stakeholders, and government entities, these initiatives facilitate the exchange of ideas, knowledge, and best practices to drive responsible innovation in the fintech ecosystem.

Governor Das highlighted the RBI’s commitment to fostering a robust and inclusive digital financial ecosystem in India. Through institution building and policy interventions, the central bank is spearheading the country’s fintech revolution while emphasizing the importance of transparency, stability, and consumer protection in the evolving financial landscape.

“Designing solutions that safely and efficiently meet customer needs would not only elicit trust of customers, it would also meet business objectives in a sustainable manner. This can be achieved through simplified user interfaces and quick customer grievance redress mechanisms,” Das said.

RBI Governor Shaktikanta Das identified three critical aspects to strengthen the fintech sector: customer centricity, governance, and self-regulation. He emphasized the importance of understanding and addressing customer needs while safeguarding their interests and maintaining trust in the rapidly evolving fintech landscape.

Customer Centricity: Ensuring customer-centric services is essential for the fintech sector’s success. This includes protecting customer data, providing transparent policies, and offering seamless user experiences. By prioritizing customer needs and maintaining their trust, fintech companies can build long-lasting relationships with their user base.

Governance: Strong governance mechanisms are vital in promoting transparency, accountability, and ethical practices within the fintech industry. This involves setting clear regulatory guidelines and standards for fintech players, fostering a culture of compliance, and creating a level playing field for all stakeholders.

Self-Regulation: Encouraging self-regulation among fintech firms is crucial in ensuring responsible innovation. By establishing industry-wide best practices, fintech companies can collaboratively create a more resilient, secure, and inclusive financial ecosystem. This will not only enhance consumer confidence but also promote long-term growth and sustainability in the fintech sector.

Good governance is indeed crucial for the long-term success and sustainability of fintech companies. It ensures that these organizations operate responsibly, transparently, and in compliance with regulatory requirements.

Das said, “A robust governance structure encompasses clear delineation of roles and responsibilities, transparent decision-making processes, accountability mechanisms, and stakeholder engagement. Good governance must focus on ensuring effective oversight, ethical conduct and risk management.”

Here are some key aspects of good governance in the fintech sector:

Strong Leadership and Oversight: Effective leadership and oversight from the board of directors and management teams are essential in establishing a culture of good governance. This includes setting clear strategic goals, promoting ethical behavior, and ensuring accountability at all levels of the organization.

Risk Management: Fintech companies must implement robust risk management frameworks to identify, assess, and mitigate potential risks. This involves regularly monitoring and addressing issues related to cybersecurity, data privacy, financial crime, and operational resilience.

Regulatory Compliance: Adhering to relevant laws, regulations, and industry standards is crucial in maintaining the trust of customers, investors, and regulators. Fintech firms should invest in compliance programs that ensure ongoing adherence to applicable regulations.

Transparency and Disclosure: Fintech organizations should promote transparency by providing accurate, timely, and relevant information to stakeholders. This helps build trust, enhance reputation, and enable informed decision-making.

Stakeholder Engagement: Engaging with stakeholders, including customers, investors, regulators, and employees, is essential in understanding their needs and addressing their concerns. This fosters collaboration and helps align the organization’s goals with stakeholder expectations.

By embracing good governance practices, fintech companies can navigate the rapidly evolving industry landscape while ensuring long-term success and resilience. This not only strengthens the individual firms but also contributes to the overall growth and credibility of the fintech sector.

RBI Governor Shaktikanta Das stressed the importance of robust consumer protection measures to foster trust in the financial system. He acknowledged that while green bonds and deposits offer numerous advantages, they also encounter obstacles, with scalability being a significant concern.

Despite the potential of green bonds in promoting sustainable finance, their market must grow to encourage larger issuances and attract a broader range of investors. This would help address scalability challenges and ensure these instruments become more accessible and appealing to various stakeholders.

To achieve this, it is crucial to develop a supportive ecosystem that includes clear regulatory guidelines, transparent reporting standards, and incentives for both issuers and investors. By creating a more conducive environment for green bonds, the financial sector can better contribute to the global transition towards a low-carbon and sustainable economy.

Green bonds and deposits present opportunities for promoting sustainable finance, addressing the scalability challenge is crucial to unlocking their full potential. By focusing on market expansion and fostering an enabling environment, the financial sector can harness these instruments’ power to drive positive change and support long-term sustainability goals.