IFTA FOSTERING INNOVATIVE COLLABORATIVE ECOSYSTEM

The highly anticipated India FinTech Summit 2024, theme – “AI-Driven Fintech: Shaping the Future of Finance,” focused on the seamless integration of Artificial Intelligence (AI) and Financial Technology (Fintech), as it continues to redefine the financial landscape, as we aim to explore the limitless possibilities that this dynamic partnership brings forth.

IFTA 2024 delved into the transformative impact of AI-driven Fintech on various aspects of the financial ecosystem, including enhanced personalization, bolstered security, and streamlined efficiency. The event featured insightful discussions and showcases of groundbreaking advancements that are revolutionizing our understanding and approach to finance.

Mr. Prasanna Lohar – Chief Executive Officer, Block Stack and Convenor, IFTA 2024 presented on Pioneering Future Finance: Vision 2030 and Beyond, some takeaways.

Digital Transformation of Banking Infrastructure

Prasanna Lohar envisions a fundamental shift in banking infrastructure by 2030, moving away from traditional core banking models toward data-centric frameworks. This transformation represents a pivotal change in how financial institutions will operate in the future.

From Core-Centric to Data-Centric Banking

The future of banking will witness a foundational shift where “the core is moving the center has moved to data now because the minute you start seeing data as the center your opportunities are infinite”. This perspective aligns with the industry-wide recognition that data, rather than traditional banking cores, will drive innovation and create unlimited possibilities for financial services.

API-Driven Banking Ecosystems

A critical component of this transformation is the development of robust API layers. These will enable financial institutions to meet customers where they are rather than expecting customers to come to them. As Lohar notes, “API is as important as data because finally what is happening… no longer Banks can hope that they will ask customers to come and meet them where they want to”[5]. This shift toward API-driven banking reflects the growing importance of embedded finance and Banking-as-a-Service (BaaS) models that will define the 2030 landscape.

Emerging Technologies Reshaping Finance

The financial ecosystem of 2030 will be fundamentally transformed by several deeptech innovations that are already gaining momentum today.

AI-Driven Financial Intelligence

Artificial intelligence will evolve from today’s basic applications to become the cornerstone of financial services by 2030. The future includes “AI-powered co-pilots for financial insights” and “self-learning risk models via Quantum Computing”. This aligns with the IFTA 2024 theme of “AI-Driven Fintech: Shaping the Future of Finance,” which explores “how AI is revolutionizing the way we think about finance”.

India’s Digital Public Infrastructure Evolution

Lohar’s vision builds upon India’s impressive progress in creating robust digital public infrastructure for financial services.

DPI 2.0: The Foundation for Inclusive Finance

India’s Digital Public Infrastructure (DPI) will evolve into more sophisticated applications by 2030, building on current successes. Already, “UPI now power[s] nearly half of global real-time payment transactions” and has enabled innovations like “credit on UPI, cross-border payments, UPI circle”. The Account Aggregator framework has reached “over 100 million cumulative consents,” while the introduction of the Unified Lending Interface (ULI) represents “another transformative development, particularly for rural credit”.

From Infrastructure to AI-Powered Public Good

The evolution of India’s DPI will increasingly incorporate artificial intelligence, as evidenced by the year-end release of “MuleHunter by RBI Innovation Hub (AI-powered system to combat financial fraud) [which] represents a fascinating evolution in India’s DPI approach: using artificial intelligence to build public digital infrastructure”.

Regulatory and Governance Frameworks

The financial ecosystem of 2030 will require evolved regulatory approaches that balance innovation with stability.

Adaptive Regulatory Models

Lohar recognizes that emerging technologies must be accompanied by “robust regulatory frameworks to ensure responsible and secure implementation”. His Web3.0 trends report identifies “Regulatory Developments” and “Global Regulatory Frameworks” as key areas for the future, highlighting the importance of compliance without stifling innovation.

Cross-Industry Partnerships

The future of finance depends on collaboration between traditional financial institutions, fintechs, technology providers, and regulatory bodies. Lohar has advocated for “Open-Source Collaboration” and emphasized the importance of building ecosystems that connect various stakeholders.

The Integrated Vision for 2030

Prasanna Lohar’s vision for finance in 2030 integrates technological innovation with human-centered design and regulatory foresight. The financial ecosystem will evolve beyond traditional banking models toward “Banking without Banks” where institutions function as “trusted digital custodians”.

The transformation will be powered by quantum computing, blockchain, and artificial intelligence, enabling instant settlement, seamless cross-border transactions, and personalized financial services. This vision aligns with global “Vision 2030” initiatives but brings a uniquely Indian perspective shaped by the country’s success with digital public infrastructure.

By 2030, we can expect a financial system that is more inclusive, efficient, and responsive to human needs-one that leverages technology not as an end in itself, but as a means to create greater financial wellbeing for individuals and communities worldwide.

Perfios, India’s leading B2B SaaS Fintech company, partnered with PwC India to release a comprehensive report titled “How India Spends: A Deep Dive into Consumer Spending Behaviour.” The report examined the spending habits of over 30 lakh tech-savvy consumers across various demographics, shedding light on India’s evolving consumption patterns.

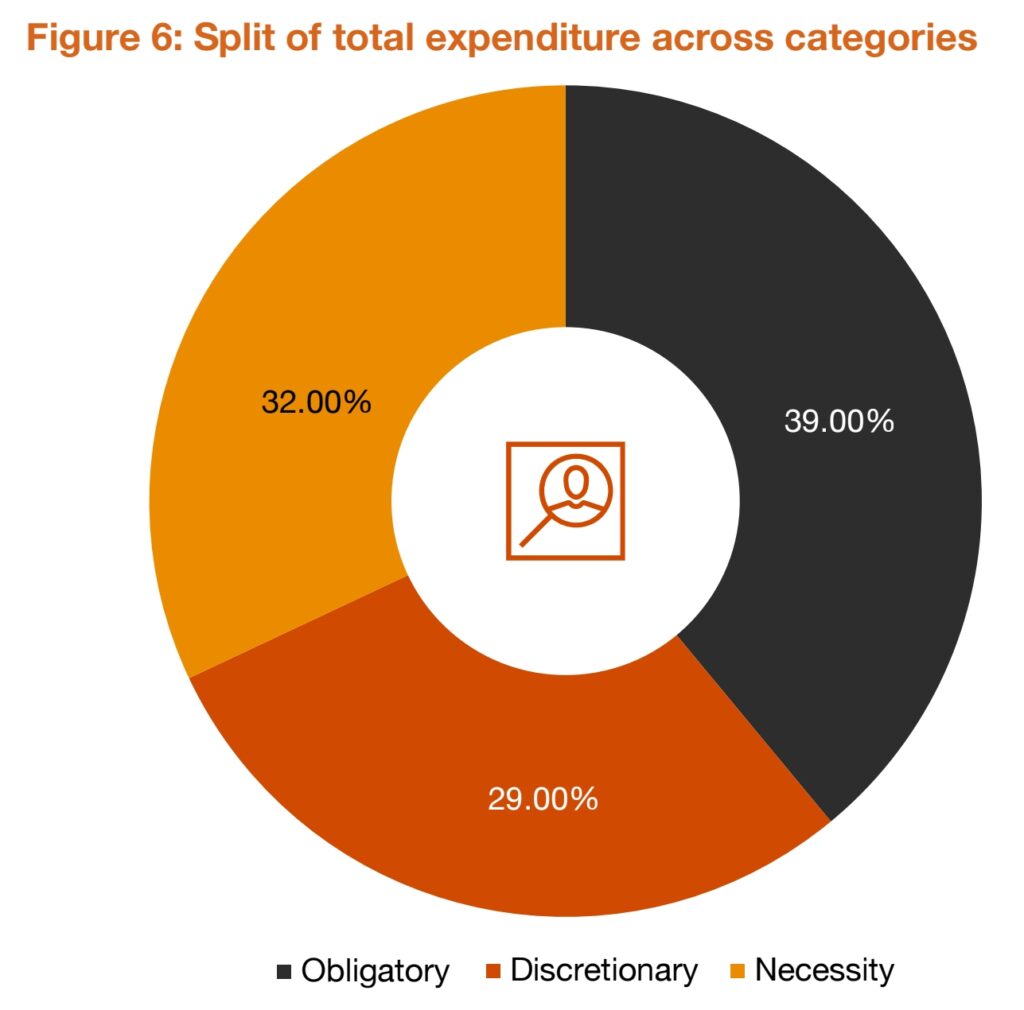

The study found that 39% of consumers’ total spending goes towards obligatory expenditures, with 32% being allocated to loan repayments. This highlights the significant role that credit plays in financing Indian consumers’ lifestyles and aspirations.

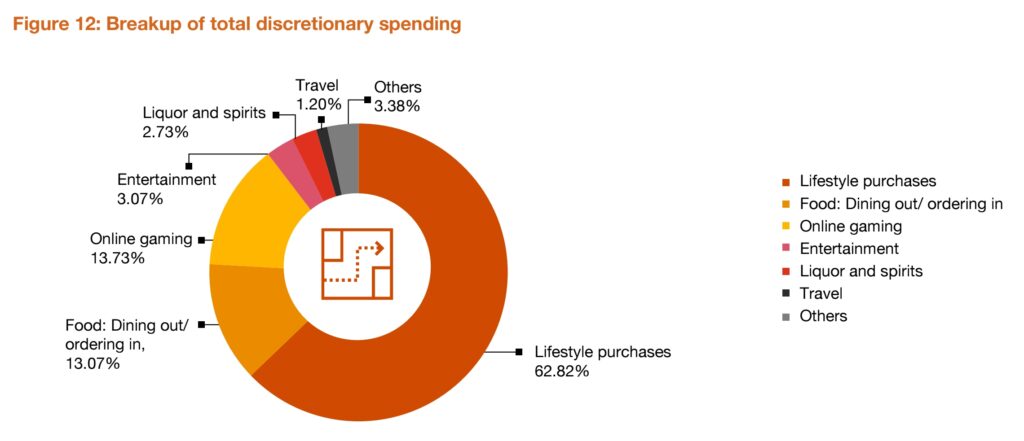

Additionally, the report revealed that 62% of discretionary spending is directed towards lifestyle purchases, indicating a growing emphasis on quality of life among Indian consumers. The study also found that income levels, digital payments, and changing lifestyles are key factors shaping India’s spending behaviour.

Overall, Perfios and PwC India’s collaboration has provided valuable insights into the financial habits and priorities of Indian consumers, offering businesses and policymakers a deeper understanding of the country’s evolving consumer landscape.

Traditionally, necessary and obligatory expenses have taken precedence over discretionary spending due to the importance of fulfilling essential needs and financial obligations. However, the emergence of various lending options such as embedded finance, peer-to-peer loans, credit cards, and traditional loans like home, education, and auto loans has transformed how individuals manage their finances.

As these lending alternatives become more accessible, the distinction between discretionary spending and future obligations has become less clear-cut. Nowadays, individuals are increasingly utilizing credit to finance lifestyle purchases and experiences that were once considered discretionary. This shift reflects the growing influence of credit in shaping consumer spending patterns and the evolving dynamics of personal finance in today’s society.

More than 62% of discretionary expenditures are allocated towards lifestyle purchases, which include shopping for fashion and personal care items.

Mihir Gandhi, Partner and Leader-Payments Transformation, PwC India added , “PwC India is pleased to collaborate with Perfios as the knowledge partner for this inaugural edition. This report is designed to help businesses, policymakers, and financial institutions understand evolving consumer behaviour and make informed decisions in a dynamic marketplace.

Sabyasachi Goswami, CEO, Perfios, stated that “India’s consumer market is undergoing a transformation which is fuelled by the rising middle class, expanding rural markets and a digitally connected, aspirational population. As we witness rapid shifts in consumer behaviour, understanding how India spends becomes essential for financial institutions, policymakers and businesses which are looking to engage effectively with this dynamic market.

Mr. Vikaas M. Sachdeva – Managing Director, Sundaram Alternates, welcome address on How Financial Literacy Empowers Informed Decisions Related to Money, underscored the transformative role of financial education in bridging the gap between technological innovation and socioeconomic inclusion. Drawing from Sachdeva’s expertise in alternative investments and his advisory role at the India FinTech Forum, the discussion highlighted the intersection of AI-driven fintech solutions, regulatory evolution, and grassroots financial empowerment. Below is a synthesis of the session’s core themes and actionable insights.

1. Financial Literacy as a Catalyst for Inclusive Growth

1.1 Redefining Financial Education in the AI Era Sachdeva emphasized that financial literacy must evolve beyond basic budgeting and savings to include fluency in emerging fintech tools and alternative investment vehicles. With 40,000+ students participating in IFTA’s Fintech Olympiad, the focus has shifted toward equipping younger generations with skills to navigate AI-powered wealth management platforms and decentralized finance (DeFi) ecosystems. This aligns with India’s DPI 2.0 framework, which integrates blockchain and AI into public financial infrastructure.

“The democratization of finance through technology is meaningless without parallel efforts to democratize financial knowledge.” – Paraphrasing Sachdeva’s advocacy for education-first fintech adoption.

1.2 Bridging the Urban-Rural Divide The session highlighted Sundaram Alternates’ initiatives to extend financial literacy to rural India through **tokenized agricultural credit systems** and **AI-driven microloan platforms**. By translating complex financial products into vernacular interfaces, these tools empower smallholder farmers to access formal credit markets[3][14]. Sachdeva noted that similar strategies are being replicated in Tier II/III cities, where surpluses are increasingly allocated to private credit funds and Category III AIFs.

2. AI and Regulatory Tech: Reinventing Financial Decision-Making

2.1 Personalized Financial Guidance at Scale Sachdeva outlined how generative AI co-pilots are transforming financial advisory services. For instance, Sundaram Alternates’ AIF platforms now use natural language processing to explain risk-return tradeoffs in real time, reducing reliance on jargon-heavy prospectuses. This approach mirrors the RBI’s MuleHunter system, which employs AI to simplify fraud detection for end-users.

2.2 Regulatory Sandboxes and Literacy-Driven Compliance The discussion stressed the need for “iterative regulation” – frameworks that evolve alongside technological advancements. Sachdeva cited SEBI’s recent experiments with embedded supervision, where blockchain-based audit trails enable regulators to monitor AIFs without stifling innovation. For retail investors, this translates to transparent fee structures and automated compliance checks, lowering barriers to entry.

3. The Future of Investor Education: Insights from the Fintech Olympiad

3.1 Gamifying Financial Literacy IFTA’s Fintech Olympiad, supported by AMFI and Axis Mutual Fund, demonstrated how gamification can make financial education engaging. Participants tackled real-world scenarios like optimizing UPI-based microloans and mitigating crypto volatility, reflecting Sachdeva’s belief in experiential learning over theoretical pedagogy]. The competition’s regional rounds in Tier II cities (e.g., Jaipur, Coimbatore) highlighted untapped demand for fintech literacy beyond metropolitan hubs.

3.2 Curriculum Innovations for Institutional Adoption Sachdeva advocated integrating fintech literacy into mainstream education, citing Karnataka’s GCC Policy as a model. Proposed modules include: – Quantum computing basics for portfolio optimization – Smart contract auditing to combat DeFi fraud – Behavioral economics to counter cognitive biases in investing These initiatives aim to create a talent pipeline for India’s $5 trillion fintech market while addressing Sachdeva’s observation that “90% of AIF investors lack the tools to independently evaluate risk”.

4.0 Collaborative Ecosystem Building

The session concluded with a call for public-private partnerships to scale literacy initiatives. Examples include:

– Banks as financial literacy hubs: Utilizing RBI’s 150,000+ BC outlets for community workshops

– AIF-sponsored edtech grants: Tax incentives for funds allocating 0.1% of AUM to investor education

– Celebrity endorsements: Leveraging influencers to dismantle stigmas around debt and equity

Literacy as the Bedrock of Financial Innovation

Mr. Vikaas M. Sachdeva’s insights at IFTA 2024 paint a future where financial literacy and technological innovation are inseparable. By prioritizing education, India can transform its 1.4 billion population from passive savers to informed investors, unlocking $40 billion in annual alternative investment inflows by 2030. The roadmap hinges on three pillars: simplification (via AI/ML tools), institutional collaboration (regulators + fintechs), and cultural shift (normalizing financial planning as a life skill). As Sachdeva succinctly noted, “The true measure of fintech’s success isn’t in the apps we build, but in the decisions they empower.” With IFTA 2024 setting the agenda, the journey toward a financially literate India has shifted from aspiration to actionable strategy.

Navigating the Fintech Ecosystem: Fintech Innovations to Watch in 2025Speaker(s)Mr. Vasanth Jeyapaul CEO, CAMSPay Mr. Bertram D’souza Chief Product & Innovation Officer, Protean eGov Technologies, Ms. Priyanka Kanwar Co-Founder & CEO, Falcon, Mr. Hersh Sayta Anchor & Sr. Research Analyst, NDTV Profit, (Moderator)Mr. Abhilash Misra Chief Executive Officer, NSE Academy, discussed emerging trends shaping the financial technology landscape.

Mr. Jeyapaul emphasized the evolution of real-time payment systems, particularly with the advancement of 5G technology enabling faster, more reliable transactions with ultra-low latency. He discussed how payment innovations are becoming more inclusive and accessible through AI-driven solutions that align with IFTA 2024’s overall theme of making financial innovation accessible to all. He possibly highlighted the integration of biometric payment systems, which represent one of the top fintech innovations to watch in 2025.

Mr. Bertram D’souza discussed how open banking APIs are becoming crucial for creating unified user experiences while safeguarding data through secure endpoints. He addressed the growing importance of RegTech solutions that use AI and machine learning to monitor transactions and identify potential regulatory risks. He likely shared insights on how consent-based data sharing between financial institutions is revolutionizing financial inclusion.

Ms. Priyanka Kanwar discussed how entrepreneurs are building innovative technologies that redefine convenience, speed, and accessibility in financial services. She addressed embedded finance trends, where financial services are integrated into non-financial platforms like e-commerce and ride-sharing apps. Given the growing importance of AI in fintech, she shared perspectives on how AI is enabling hyper-personalized financial services and behavioral finance insights for startups and established players alike.

Mr. Abhilash Misra highlighted the importance of financial literacy and talent development in supporting fintech innovation, similar to how the Fintech Olympiad (part of IFTA 2024) attracted over 40,000 registrations from 2,000+ colleges across India.He discussed how education is critical for addressing the fintech talent gap, as the sector is expected to receive over $300 billion globally by the end of 2025. His insights included perspectives on how academic institutions can collaborate with industry to prepare students for emerging opportunities in AI-driven fintech solutions.

The “Navigating the Fintech Ecosystem” panel at IFTA 2024 brought together diverse expertise spanning payments, digital infrastructure, entrepreneurship, education, and market analysis. While specific quotes from each speaker aren’t available, their combined insights likely painted a comprehensive picture of how AI, embedded finance, tokenization, open banking, and regulatory technology will shape fintech innovation in 2025 and beyond.

As the fintech sector continues its explosive growth, these innovations will play crucial roles in making financial services more accessible, efficient, and inclusive for all stakeholders in the ecosystem.

Mr. Jalaj Sinha Head Of Business Development presented about Qapita.

Qapita was nominated for the Best FinTech of the Year award at the IFTA 2024. This recognition was for their work in equity management, specifically in transforming how companies manage their employee stock ownership plans (ESOPs). Although they did not win, the nomination is seen as a validation of their efforts in this area.

“Though we did not take home the trophy, we are confident that we won many hearts with our unwavering commitment to transforming equity management. This recognition is a testament to the impact we are making in simplifying equity processes and empowering companies, investors, and employees across the ecosystem,” Sinha noted.

1. Industry Recognition: The nomination itself validated Qapita’s growing influence in the fintech space, particularly in equity management solutions.

2. Ecosystem Impact: Sinha emphasized how the nomination reflected Qapita’s success in simplifying complex equity processes for various stakeholders across the financial ecosystem.

3. **Collaborative Success**: He acknowledged the crucial role of Qapita’s team, partners, and customers in achieving this industry recognition.

4. Future Innovation: Looking ahead, Sinha expressed enthusiasm about continuing to drive change in the equity management space, suggesting that “the best is yet to come”

Qapita’s Equity Management Solutions

As Head of Business Development, Jalaj Sinha has been instrumental in promoting Qapita’s comprehensive equity management platform, which has gained significant traction in the market. The company now serves over 2,400 clients and 350,000 employee owners.

Qapita’s solutions focus on two primary areas:

1. Digital Cap Table and ESOP Management: Their platform helps companies digitally manage ownership records and employee stock option programs with greater efficiency and transparency.

2. Liquidity Solutions: Qapita also provides marketplace solutions for shareholder and employee liquidity, addressing a critical need in private markets.