BHARAT FINTECH FORCE

Focused on the expansion of Enterprise Fintech expansion and Retail & SME Finance Digitization by 2030, the Digital Fifth’s 2nd Edition of the Bharat Fintech Summit was hosted in Mumbai on February 7 and 8, 2024, with the goal of tapping into the constantly changing banking and financial services ecosystem.

India’s fintech industry is currently ranked among the best in the world and is predicted to make a significant contribution to the country’s target of becoming a $7 trillion economy by 2030. The Bharat Fintech Summit offered a forum for in-depth discussions on the constantly changing Fintech ecosystem and its profound impact on BFSI Business Models.

“Our primary objective is to empower each participant with valuable insights and knowledge, facilitating collaborative efforts to catalyze innovation and advancing digitization. We aspire to pave the way for the extensive dissemination of Digital financial services to even the remotest corners, ensuring that the benefits of the digital revolution reach the farthest segments of our society,” said, Sameer Singh Jaini, Founder of The Digital Fifth.

In the next ten years, Jaini added, banks and NBFCs would change to become all digital for the retail and MSME markets. For a larger audience, this would imply more affordable and easily available financial services.

“We organize the summit which are focused on content and depth and welcome here everybody from the entire Indian fintech ecosystem including the participation of 70 – 80 VC firms where they share fruitful insights, collaborate and intend to thrive their businesses amongst each other,” he added.

Attracting over 3000 participants, including high-ranking executives, government officials, and notable speakers from BFSI and IT sector leaders, the conclave facilitated information sharing and served as a crucial platform for gathering industry thought leaders.

While B2C fintech businesses have garnered media attention for their pursuit of initial public offerings (IPOs) and unicorn status, the remarkable emergence of Indian enterprise fintechs is sometimes overlooked. The B2B side of fintech, which is assisting the BFSI sector as a whole in going digital, was the main topic of discussion at this event. LendingTech, where companies like Perfios Software Solutions, Backbase, Vayana, Finbox, Finezza, and Synoriq are working extensively, is redefining the B2B industry. B2B Lending; Payment Technology: Zaggle, Bharatpe, EPS, Transbank; Plural by Pine Lab; Wibmo; Regtech: Signzy, Spice Route Legal, and other companies are working in this field extensively. By going public, a few B2B companies are also seeing success on the equity market.

Organisations like Hyperface (Cards), AdvantageClub (HRMS), Cygnet Digital (GST), Stellapps (Dairy Ecosystem), Tally (Accounting Platform), and Tally (Dairy Ecosystem) are developing distinctive ecosystems to enhance the current systems and promote inclusivity and creativity.

Conversely, fintechs are receiving backing from regulated institutions like as Airtel Payments Bank, Karnataka Bank, Axis Mutual Fund, Bureau, Credit Saison, and Kinara to provide digitally enabled goods to end users.

Industry insiders predict that in 2024, there will be a major digital push in the following areas: insurance, cross-border payments, B2B payments, MSME financing, and secured lending.

Deep insights into the current and next developments that will influence the industry were given at the Bharat Fintech Summit. Throughout the two days of the summit, panel talks covering the subjects of innovation, digitization, globalisation, and inclusion will be discussed.

With more than 250 speakers, 40 panels, and five tracks, the Summit promoted cooperation between major financial players in line with India’s progress in digital finance. It also included more than 50 expo booths, master classes, and product demonstrations showcasing innovation in open banking, wealth, payments, and other areas.

At the summit, in-depth talks were held on a variety of subjects, including the evolution of due diligence in fintech investments, the convergence of digital payments and credit, and reimagining the future of financial services through digital public infrastructure. Small banks are also leading the nation’s inclusion agenda.

The panel discussions covered a wide range of relevant topics, including the country’s dynamic fintech landscape, product-led innovations, much-needed collaboration between banks and fintech players, cybersecurity, and the need for increased regulatory compliance in payments and digital lending to improve customer experiences and protect them from various frauds.

India is one of the fastest-growing fintech marketplaces in the world and the third-largest fintech ecosystem worldwide. The market size of India’s FinTech sector is projected to reach ~$150 billion by 2025, from $50 billion in 2021.

Total Addressable Market for the Indian Fintech sector is projected to reach $1.3 trillion by 2025, while Assets Under Management and Revenue are expected to reach $1 trillion and $200 billion, respectively, by 2030. Payments, Digital Lending, InsurTech, and WealthTech are some of the major Fintech subsectors.

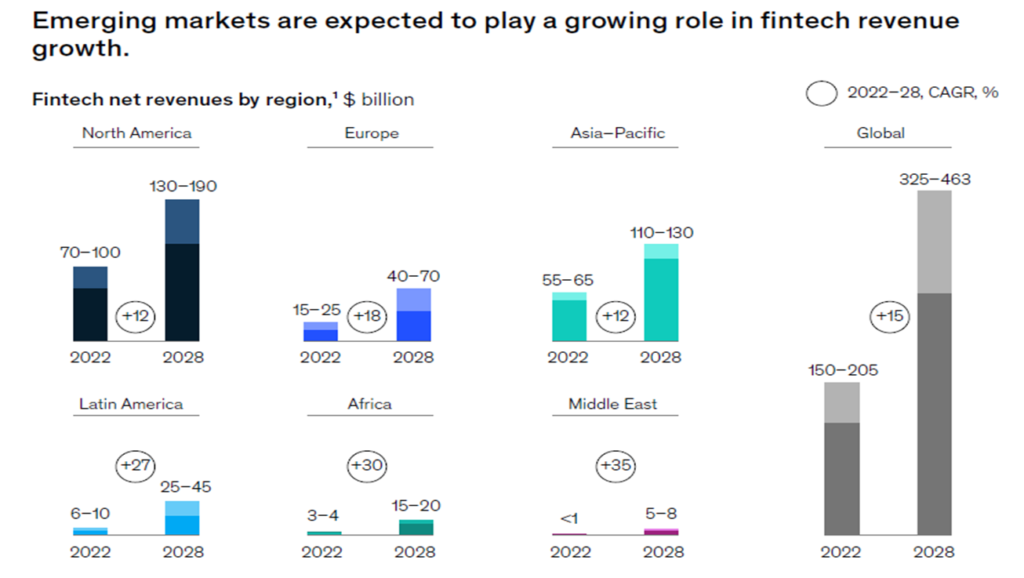

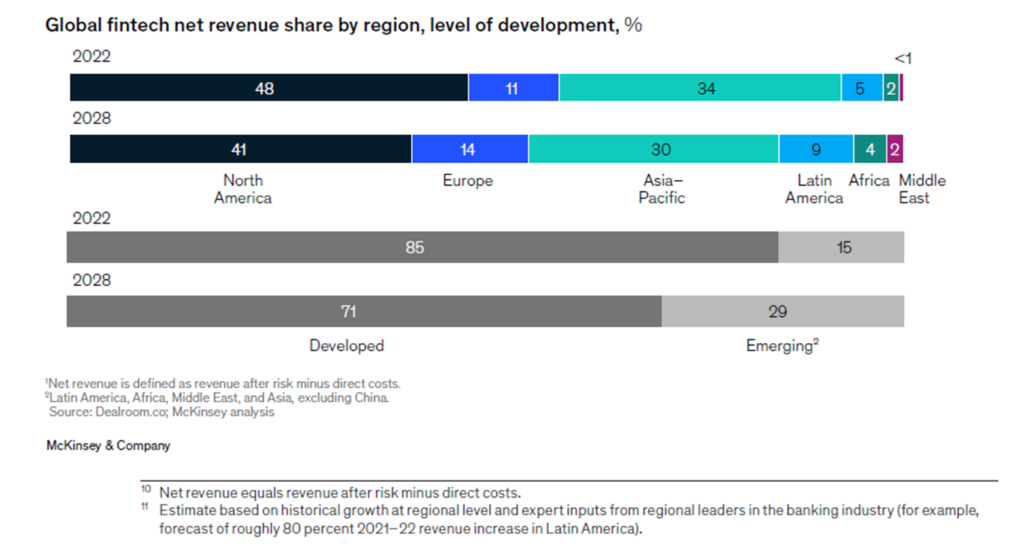

As per Mckinseys estimate, fintechs contributed between $150 billion and $205 billion, or 5 percent, to the net revenue of the global banking sector in 2022. We project that this percentage may rise to over $400 billion by 2028,11 which would imply a 15% yearly growth rate in fintech income between 2022 and 2028, which would be three times the growth rate of the banking sector as a whole, which is projected to be about 6%.

The majority of this revenue increase will come from emerging markets. 15% of fintech’s global revenues in the previous year came from sales in Africa, Latin America, Asia-Pacific (apart from China), and the Middle East. By 2028, we predict that their combined percentage would rise to 29 percent. However, it is anticipated that by 2028, North America, which already contributes 48% of global fintech revenues, would only account for 41% of the total.

Renowned dignitaries and business titans graced the occasion, which featured thought-provoking talks, entertaining presentations, and the acknowledgment of exceptional accomplishments in the fintech field.

The Reserve Bank of India’s Executive Director, Shri Vasudevan P, led the customary lamp-lighting ceremony and gave a keynote speech that explored the nuances of the country’s fintech scene to kick off the summit. His speech prepared the audience for a series of high-level panel discussions with prominent business leaders who provided their distinct perspectives and established the framework for delving into the potential futures of the fintech sector.

The Reserve Bank of India’s Executive Director, Shri Vasudevan P, was a living example of the cooperative spirit that advances our sector. His observations, together with the many panel discussions that took place over the course of the next two days, provided insight into how the fintech industry is changing and how important innovation is to it. He emphasised the value of taking risks, welcoming change, and never stopping trying to get better.

RBI executive director P Vasudevan emphasised the importance of frictionless credit, claiming it has the potential to become the next digital public infrastructure.

“It’s a vibrant experience for me to attend such a summit and also marked presence in one the panel where we discussed tech led credit networks, leveraging multi-layered lending partnerships and cutting-edge tech for the future-ready financial sector.

Panel topic: It takes two to Tango: Shifting from “Product” to “Partner” Focus, speakers:

Rajeev Ahuja, Executive Director RBL Bank, Tejas Goenka, Managing Director, Tally Solutions Pvt Ltd, Nitin Chugh, Deputy Managing Director, State Bank of India and moderated by Sameer Singh Jaini, Founder & CEO, The Digital Fifth.

The discussion was on Bank Fintech partnership – the way forward in the new open banking era. The most important things that banks consider when assessing fintech collaborations are emerging technology advances in lending that promote collaborations. Obstacles related to governance and compliance that must be considered and requisite corrections made and implemented.

The key findings are as follows: Banks are increasingly looking to partner with fintech companies to provide new and innovative financial services. There are three main areas where banks and fintech companies can partner:

- Technology partnerships: Banks can use fintech companies’ technology to improve their own products and services.

- Infrastructure partnerships: Banks can provide fintech companies with access to their infrastructure, such as their payment processing systems.

- Business model partnerships: Banks and fintech companies can work together to develop new business models.

Some of the challenges of bank-fintech partnerships include:

- Ensuring that both partners are aligned on the goals of the partnership

- Managing data security and privacy risks

- Complying with regulations

- Despite these challenges, bank-fintech partnerships have the potential to revolutionize the financial services industry.

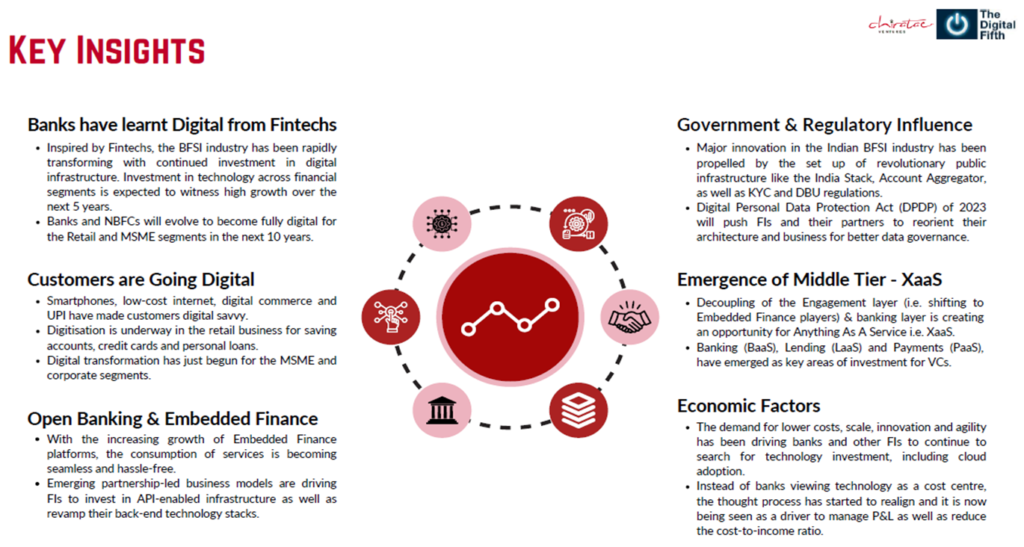

Chiratae Ventures and The Digital Fifth launched the Indian Enterprise Fintech Report 2024, titled Unlocking the Indian Enterprise Fintech Market, in February 2024. The research predicts that the Indian enterprise fintech industry would reach a market size of roughly $20 billion by 2030, up from $2.7 billion in 2022.

The analysis identified considerable development opportunities in key fintech areas in India, such as banking tech, regtech, enterprise wealth tech, lending tech, and enterprise insurtech. Key findings from the research included the emergence of business fintech, the shift to 100% digital banking by 2030, and the rising role of technology as a strategic revenue generator.

This report focuses on Enterprise FinTechs, which play a critical role in optimising product, sales, and service delivery while also increasing efficiency within the BFSI segment in six key sectors: BankingTech, LendingTech, PayTech, RegTech, InsurTech, and WealthTech.

Perfios was the presenting sponsor for the Bharat Fintech Summit 2024, and the cooperation was critical to the event’s success.

Perfios’ Chief Strategy Officer, Ramgopal Subramani, praised the summit, stating that such events are critical in allowing information sharing, building collaborations, and driving holistic sectors growth. “At Perfios, we are happy to partner with events like BFS that serve as collaborative platforms across the BFSI sector to address challenges and explore innovative opportunities,” he said.

The panelists for the “Entrepreneurial X-Factor: Traits That Attract Early-Stage Investors” session at the 2024 Bharat Fintech Summit were:

Sameer Singh Jaini, Prachi Dharani, Anuradha Ramachandran, Mandeep Julka, CFA, Movin Jain, Shashank Shekhar, Sreekant Rudrabhatla

According to Movin Jain, Founder of Skydo, a cross-border payments platform, who was a panelist in the session on “Entrepreneurial X-Factor: Traits That Attract Early-Stage Investors”, a combination of factors such as a good prevailing market environment during its seed round, good reputation from previous stints and relevant experience helped Skydo raise its seed round quickly.

“Choosing the right cofounder is much more important than choosing the right business idea. With alignment on values, shared objectives, and complementary skills, you will eventually arrive at the right business idea,” Movin said.

Here are some of the key insights from the panel discussion –

The panelists emphasized the importance of having a clear and compelling business vision to attract early-stage investors.

They also highlighted the need for entrepreneurs to have relevant experience and a good reputation in order to build trust with investors.

According to Movin Jain, founder of Skydo, a combination of factors such as a favorable market environment, a good reputation, and relevant experience helped the company raise seed funding.

The panelists also discussed the importance of being obsessed with providing value to customers rather than just focusing on revenue growth and pleasing investors.

They cautioned against taking an unhealthy approach to sales, tying up with NBFCs to offer loans to customers, and using conventional strategies to boost numbers.

Overall, the panel discussion provided valuable insights into the traits that early-stage investors look for in entrepreneurs and the importance of balancing revenue growth with providing value to customers.

The report titled “Fintech: India’s $1Tn Digital Finance Opportunity” published by Chiratae Ventures provides valuable insights into the growth of the fintech industry in India and the potential it holds. Here are some key takeaways from the report, including future size and statistics:

- India is currently home to 2,500+ fintech companies, and the industry is expected to grow significantly in the coming years.

- The report identifies four major segments that will contribute to the $1 trillion digital finance opportunity in India: lending, insurance, investment, and digital payments.

- The total addressable market for these segments is estimated to be worth $1.3 trillion by 2025.

- The lending segment is expected to be the largest contributor, accounting for around 50% of the total market.

- The insurance segment is also poised for growth, with the overall insurance penetration rate currently at 4.2% and expected to increase.

- The investment segment, while currently small, is expected to grow rapidly as digital wealth management solutions become more popular.

- The digital payments segment is already well-developed in India, with UPI transactions reaching a record high of 5.9 billion in April 2023.

- The report also highlights some key trends and challenges in the fintech industry, including the need for innovative technologies and increased financial inclusion.

Overall, the report suggests that India’s fintech industry holds significant potential, and the coming years will see significant growth in all segments of the digital finance market.

Sanat Rao – Entrepreneur / Digital Anthropologist & AI Ethicist; CEO – Infosys Finacle, presented on “Gen AI & Human Alchemy – a fusion of bytes and beings.” Sanat emphasizes in an age when technology and human existence are becoming increasingly intertwined, the people dimension is an increasingly intriguing journey in which technology and humanity have the potential to unite in harmony.

Sanat highlights the importance of considering the human element in our increasingly technology-driven world. This people-centric perspective is essential to harness the full potential of technology, ensure its responsible development, and foster a future where technology and humanity flourish together.

To expand on Rao’s statement, we must first understand the “people dimension.” It refers to the human aspects of this technological journey, including individual experiences, societal impacts, and ethical considerations that arise as technology becomes more integrated into our lives. By examining the human aspects, we can better understand how technology affects us and how we, in turn, shape technology’s trajectory.

In this era of rapid technological advancements, the coalescence of technology and humanity has far-reaching implications. It enables us to leverage technology’s power to augment human capabilities, redefine the way we live and work, and solve some of the world’s most pressing challenges. At the same time, the fusion of technology and human life also raises crucial ethical questions regarding privacy, security, and the equitable distribution of technology’s benefits.

As a society, we must address these ethical concerns and promote responsible innovation, ensuring that technological advancements serve the greater good and improve human well-being. By striking the right balance between technological progress and human values, we can pave the way for a future where technology and humanity exist in harmony, ultimately unlocking the immense potential that their convergence holds.

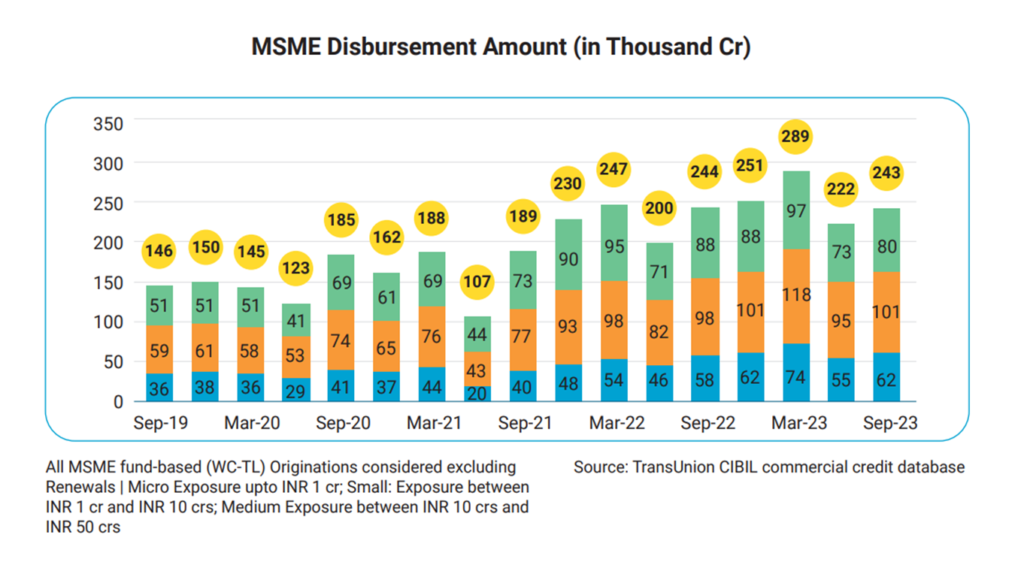

MSMEs Powering India’s $5 Trillion Dream panel discussion at the Bharat Fintech Summit 2024:

Accelerating the flow of financing to small businesses is vital for India to reach its $5 trillion economic objective by 2025, as the MSME sector has been a significant driver in the country’s emergence as the world’s fifth biggest economy.

With 63.4 million units across the country, the MSME sector accounts for approximately 6.11% of the manufacturing GDP and 24.63% of the GDP from service activities.

While statistics indicate that MSMEs have the potential to power India’s objective of becoming a $5 trillion economy by 2025, the industry still faces a massive credit shortfall of INR 25 trillion. This suggests that there is an urgent need to boost the loan disbursement rate to the MSME sector.

The panel discussed the importance of MSMEs in driving India’s economic growth and achieving the $5 trillion GDP target. They highlighted the need for improving access to finance for MSMEs, especially through digital lending platforms and fintech solutions. The panel also emphasized the role of technology in enabling MSMEs to become more competitive and efficient, through the adoption of digital payments, AI, and blockchain solutions. They discussed the challenges faced by MSMEs in terms of access to markets, skilled labor, and regulatory compliance, and the need for policy reforms to address these issues. The panelists also shared success stories of MSMEs that have leveraged technology and innovative business models to achieve scale and growth.

MSMEs’ development and success are inextricably linked to the revolutionary potential of fintechs and the collaboration between government initiatives, traditional financial institutions, and fintech startups.

Overall, the panel discussion underscored the crucial role of MSMEs in India’s economic development and the importance of providing them with the right ecosystem of finance, technology, and policy support to realize their full potential.