DUBAI NAVIGATES INSURANCE ECOSYSTEM

DIFC organized the sixth annual Dubai World Insurance Congress DWIC, March 2023, co-hosted by Global Reinsurance, the theme being “Resilience: Navigating the Storm to a Better World”. I was amazed and shocked at the magnanimous event of its kind in the region, which welcomed over 1,100 insurance leaders from 60 countries from around the world to the UAE, fostered collaborations, multimillion dollar deals and partnerships in the industry.

DWIC was held at the luxurious Ritz-Carlton DIFC and included international keynotes, networking sessions, plenary sessions, thought leaderships, series of topic-led c-suite roundtables and satellite sessions by expert international industry leaders and keynote speakers, all of whom shared their experiences, insights, and best practices.

Alya Al Zarouni, Chief Operating Officer at DIFC, said: “DIFC is the driving force behind the region’s insurance and reinsurance market and therefore the most credible co-host of the Dubai World Insurance Congress, alongside General Reinsurance. We are delighted to welcome an impressive roster of insurance leaders to the Dubai World Insurance Congress. This year, we are looking forward to advancing discussions on issues, such as talent, technology and climate change to create a more resilient future for the industry.”

The conference addressed important themes such as promoting economic expansion, luring talent to the insurance sector, embracing technology, and supporting climate change and decarbonization programmes with the agenda focused on the underinsurance gap in the area and offered a forum for significant conversations about technology, skills, and climate change.

As co-host of the Congress, DIFC has maintained its status as a major international centre for the insurance and reinsurance industry, which is home to about 100 businesses.

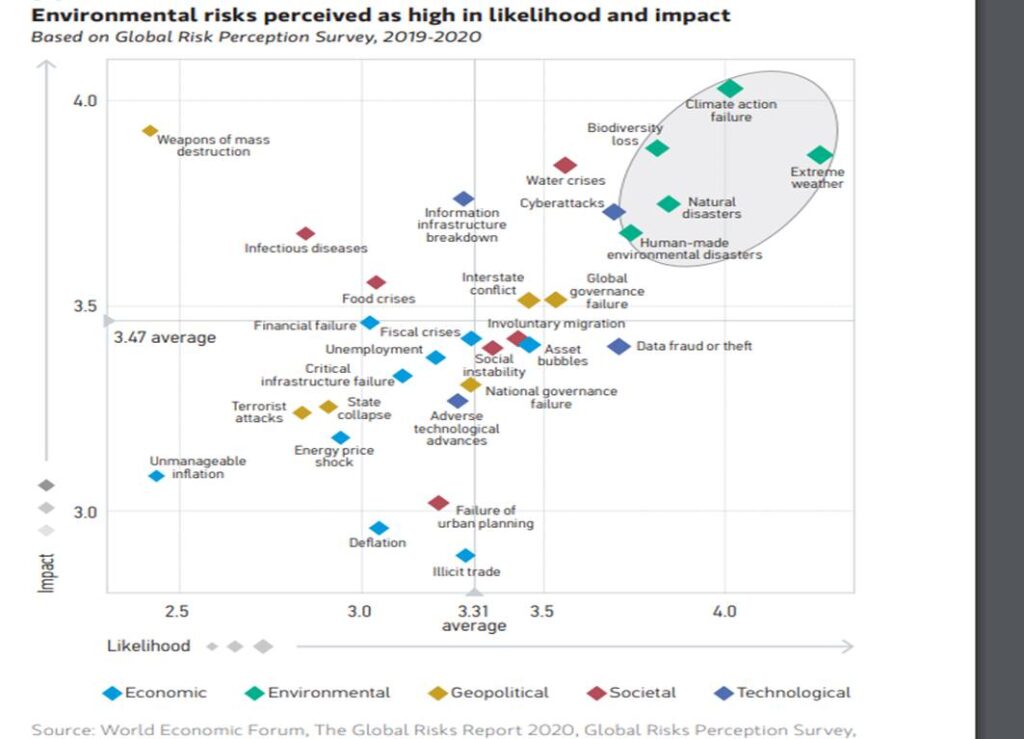

Failure to take action on climate change is listed as the top risk over the next 10 years when assessed by “impact,” and it ranks second when analysed by “probability,” according to the World Economic Forum’s Global Risk Report 2020. Environmental issues now top the survey’s list of long-term dangers for the first time.

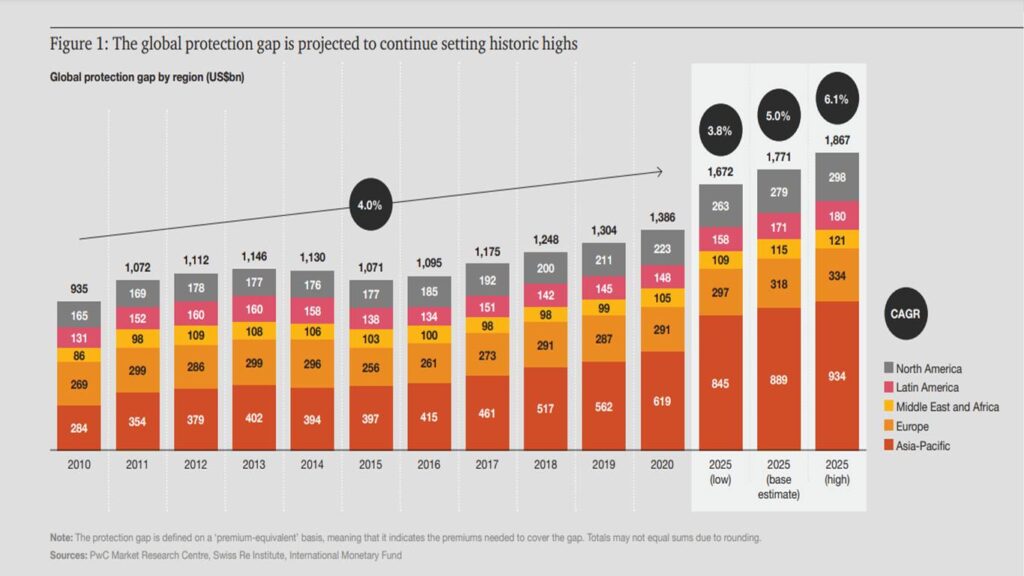

The worldwide protection gap has significantly expanded since roughly 2000 across all industries, and it will cost US$1.4tn by 2020. According to a PWC report, this gap might amount to US$1.86 trillion by 2025, with the Asia-Pacific region being responsible for over half of all uninsured risk.

The insurance business is eager to recruit new talent on a global scale, and DIFC used the Congress to launch its Talent Network. The DIFC’s 4,300 businesses have a single location to discuss job opportunities and connect with candidates, and the Talent Network offering streamlines the process for top local and international talent looking for employment in the DIFC.

Since its founding in 2017, DIFC and Global Reinsurance have co-hosted the Dubai International Insurance Congress. Since then, the event’s size has grown and it has gained the interest of the most important figures in the sector. DWIC provides attendees with the chance to network and is a wonderful venue to meet current clients. More than 5,000 meetings were pre-scheduled through the online Meeting Hub in 2022, according to DWIC.

Dame Susan Rice, Head of the Global Steering Group of the Global Ethical Finance Initiative (GEFI), was one of the distinguished group of speakers. Rice, one of the most significant female bankers in the last three decades, offered distinctive viewpoints on the insurance industry and the larger financial sector. Dame invited the insurance industry to play their role in addressing the challenges presented by climate change ahead of COP28 being held in Dubai, as part of GEFI and DIFC’s Path to COP28 programme.

In the insurance industry to succeed, talent strategy is the critical building block as core business strategy, and not to be ignored but to be taken as priority, especially driven by the rapid embracement of technology.

From an industry and technological standpoint, the insurance sector is experiencing disruption, including the advent of insurtech, more regulation, shifting demographics and talent models, mobile dominance, and new distribution methods.

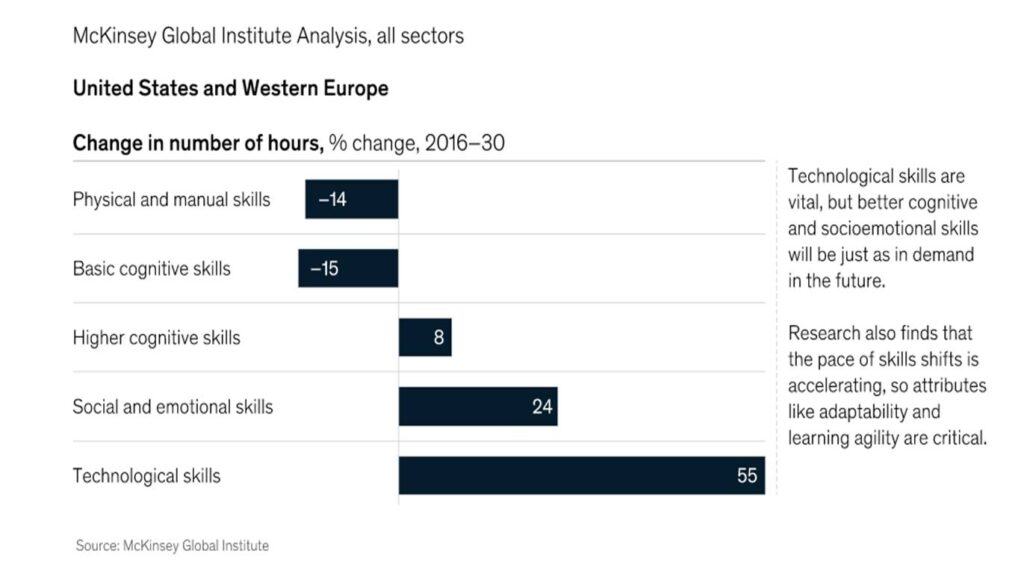

As per Mckinsey, roles are being changed by economic forces. According to our research, automation will particularly hasten the transition in the kinds of skills needed in the workforce: from now until 2030, the demand for technological skills will rise by 55%, while the demand for fundamental cognitive abilities (such data entry and processing) will fall by 15%.

Emerging techs like blockchain, artificial intelligence, and automation technologies give insurers the chance to improve productivity, create fresh working methods, and give their employees more roles with added value.

The challenges to be addressed are talent scarcity, adopting to emerging technologies faster, more innovation and upgrading of skills and data as a key talent enabler. To contribute to the sector, a new generation of talent is required and the employee value proposition should be revised.

Bridging these gaps requires approaching talent strategy with the same intensity and rigour as business strategy: quantifying needs, translating these needs into targets, committing to investments, significantly reallocating resources, and establishing discipline around execution. The industry faces significant challenges in locating the necessary talent.

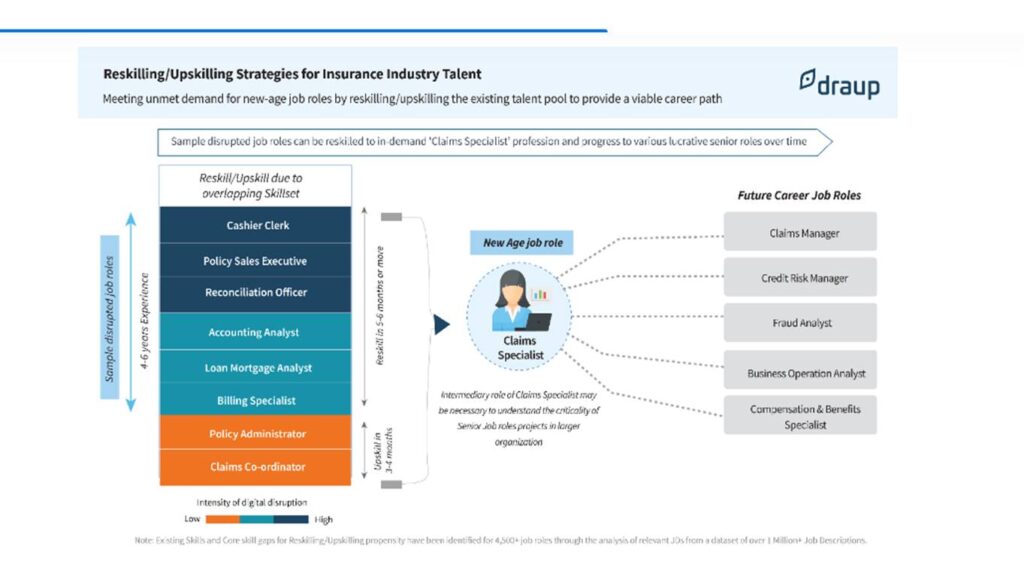

As per Mckinsey, in order to fulfil the future talent demands of insurers, reskilling is essential because it is expensive and challenging to hire for the necessary skills on the outside. While successfully reskilling an employee might save money, replacing an individual can cost more than 100% of the role’s annual compensation.

Draup.com examined numerous roles, compared them to potential future occupations, and identified the qualities people need to advance in each role. The positions that can be reskilled for the job of a claims specialist, who can subsequently be reskilled to meet future needs, are demonstrated below.

Deloitte claims that because of the ongoing rivalry for the same talent, there will be a continual demand for internal skill development. Organizations should reconsider the employee experience after the skills are acquired in order to maintain the investment in skill development. People can accomplish the things they are good at if technology-driven transformation and automation are amplified together with upskilling and reskilling. Businesses can free up human potential to concentrate on more “human activities,” like communication, customer service, and customer experience, by redefining the work and automating or rearranging low-value tasks.

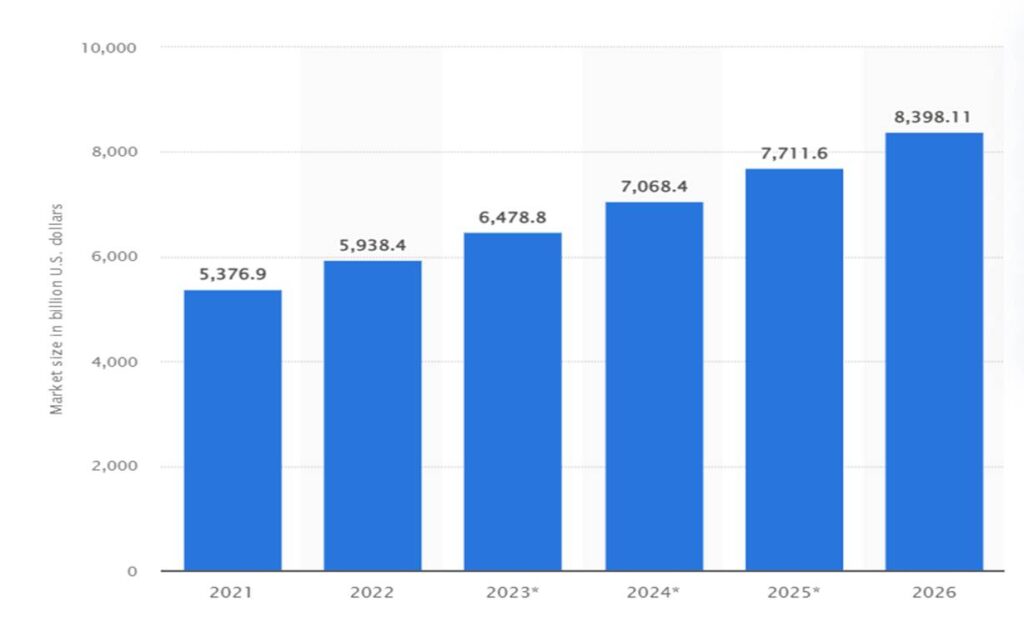

The global insurance market is predicted to grow at a compound rate of around nine percent per year, reaching almost 8.4 trillion U.S. dollars in 2026 (as above).

On Day 1 of DWIC, back of the DIFC’s Talent Week, a panel of experts discussed the skills gap for the insurance sector and how to close it, was chaired by Gracita Aoa-de Gracia, assistant vice president – Insurance and Reinsurance, DIFC, and the panel of experts – Simon Price, chief executive, DIFC Insurance Association, Andy Woodward, regional head, Middle East & Turkey, Lloyd’s and Brad Boyson, co-founder, HR Learn In, all agreed, in order to overcome the skills gap that the insurance business is currently experiencing globally, insurers and brokers must first accept the change that has taken place since the epidemic.

Insurance sector have a more traditional outlook while DIFC businesses have embraced practises like hybrid working. “In the DIFC we have a role in changing some of these established attitudes,” he said, revealing the Centre has set up a mentoring program to share international best practice with local markets. One speaker said, “After COVID, people are looking to have a different work profile.”

The panel examined, among other things, how the industry should inspire young people and promote more inclusive and varied cultures in order to recruit and keep the skills and talent it requires.

One panellist observed, “You don’t ‘dabble’ in any market. “Either you dedicate yourself to the Middle East, or you don’t do anything at all. It’s a huge obstacle. People are always looking for talent who is knowledgeable about the area because it is crucial to success.

Emerging professionals demand more than just competitive pay scales. Particularly younger generations prefer to work for companies that have excellent ESG credentials and inclusive environments.

As the sector develops, it is more crucial than ever to have a diverse set of skills because there is an increased need for chief risk, actuarial, and sustainability officers, among other positions.

As a result of the abundance of technology that enables us to interact and communicate, there is a tendency to believe that centres like the DIFC are obsolete. Personal networks, however, are becoming much more crucial because they now serve as our competitive advantage.

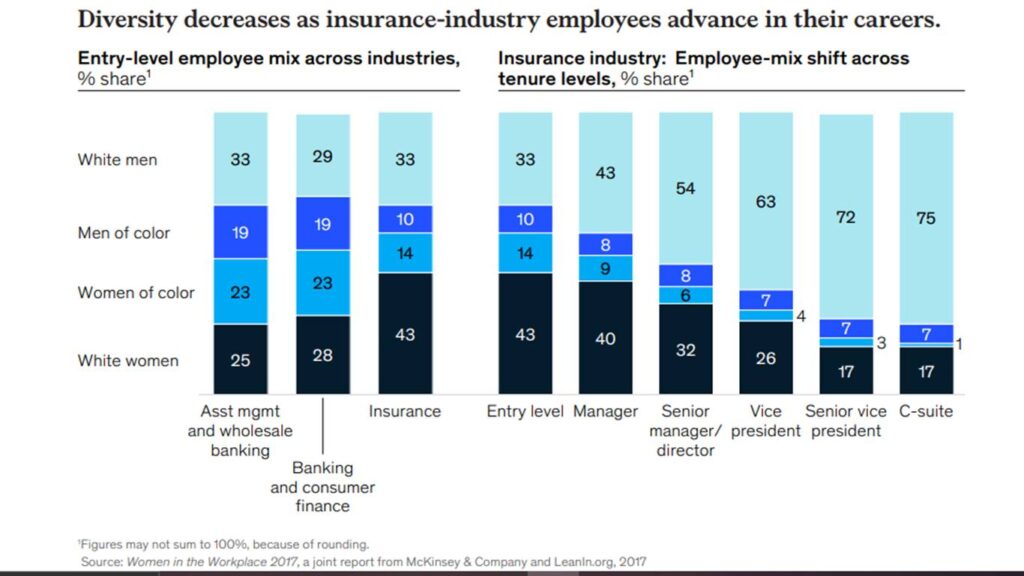

Speaking on International Women’s Day, the panelists admitted that the business still lacks gender diversity, a problem that is not limited to regional markets or even the insurance sector.

With careful people planning, the insurance industry may encourage diversity in the workforce because, per a study on multinational organizations, more diverse businesses tend to perform better.

Promoting diversity within the insurance sector should be a top priority. A more diverse workforce results in a more dynamic workplace environment that embraces broader perspectives, fosters greater cooperation, fosters greater creativity, and appeals more to millennials, making it simpler for the industry to attract new talent. Consumers are increasingly choosing which companies to support and trust based on how well those companies respect prosocial ideas like social justice. Diversity planning must be a key part of personnel strategy and workforce planning.

Delegates were informed in the opening addresses that the insurance business must “be part of the climate dialogue” with an emphasis on Dubai ahead of COP28 later this year.

“Climate, and sustainability more generally, are now becoming a core part of how organisations work and how their people make decisions,” said Dame Susan Rice, Chair of the GEFI Global Steering Group.

“Insurers are financially on the frontline of climate risks. As such, they have a strong desire to improve climate resilience, both to aid business and from a societal point of view.”

The speaker claimed that despite this emphasis, there is still a problem with the aspects of climate change that are insurable, leaving many communities financially and physically exposed to its effects.

“We witnessed this in Pakistan during last year’s devastating floods. This was a humanitarian catastrophe with $50 billion of damage, of which only $100 million was insured.”

High-intensity heavy rains and short-duration flood events are more likely to occur as a result of climate change, and as a result, flood-related losses are higher, but insurance coverage has remained dangerously low.

According to the Swiss Re Institute’s economic insights research on floods, insured damages from floods doubled to $80 billion globally between 2011 and 2020 compared to the previous decade, although insurance penetration remained at barely 18%.

Verisk does research to examine how climate change can impact risk to US agriculture. An AIR process-based Crop Growth and Yield Model is used to simulate effects of observed past and projected future climate changes on maize (maize) yield at high resolution across the U.S. Corn Belt in order to better understand and quantify the potential magnitude of climate change impacts on crops.

The constructed and natural environments, as well as our weather, are all impacted by climate change. These effects are regional, and how they affect your company will change depending on your sector, location, and vulnerability (such as what your business facilities are made from, and the services it depends on).

The effects of climate change on numerous natural disaster events, such as exposure to drought, bushfires, and floods in quick succession, add complexity.

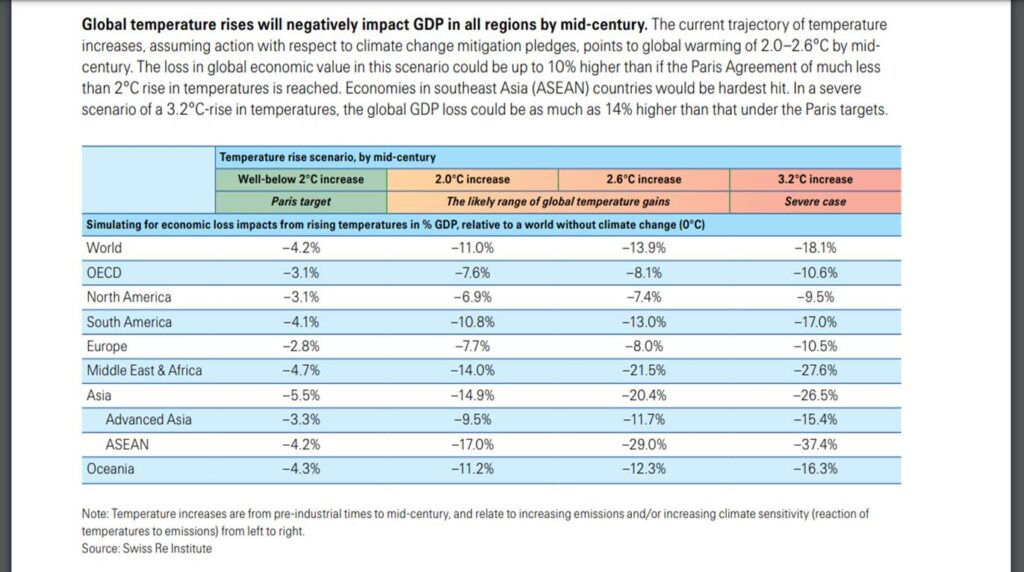

Discussing the economic implications of climate change for the industry, Haegeli highlighted the consequences of inaction and said, that the Global economic activity could be up to 10% lower by mid-century if global warming stays on its current trajectory, rather than adhering to the Paris Protocol.

“For this region, climate change is effecting the Middle East more severely and no action is not an option. The region has begun to act on mitigating climate risks and that must continue.”

According to the Swiss Re Institute, the biggest effect of climate change is that it might cause the global economy to lose up to 18% of its GDP by 2050 if global temperatures increase by 3.2°C. Climate change is a systemic risk that must be addressed now, warns Swiss Re.

A recent study (https://www.nature.com/articles/s41558-019-0444-6) looked at how climate change would influence 22 major economic sectors under two scenarios: if pre-industrial temperatures climbed by 2.8 C by 2100 and if they grew by 4.5 C. According to the report, the U.S. might lose $520 billion year due to climate change consequences on these 22 industries if the higher-temperature scenario is successful. $224 billion would be saved if we could maintain a 2.8 °C temperature. According to another study, the United States, second only to India, is poised to experience significant economic losses as a result of climate change.

Jérôme Haegeli, Swiss Re’s Group Chief Economist, said: “Climate change is a systemic risk and can only be addressed globally. So far, too little is being done. Transparency and disclosure of embedded net-zero efforts by governments and the private sector alike are crucial. Only if public and private sectors pull together will the transition to a low-carbon economy be possible. Global cooperation to facilitate financial flows to vulnerable economies is essential. We have an opportunity to correct the course now and construct a world that will be greener, more sustainable and more resilient.

According to the Swiss Re Institute report The Economics of Climate Change: No Action Not An Option, the projection of the effects of climate change was based on the assumption that temperature increases would continue on their current trajectory and that the Paris Agreement’s net-zero emission targets would not be met.

If “action is not taken,” researchers predict that 7% of the world’s GDP will be gone by the end of the century. 10% of the income of Japan, India, and New Zealand is lost. By 2100, Switzerland’s economy most likely to be 12% smaller. Russia would lose 9% of its GDP, and the UK would see a 4% decline.

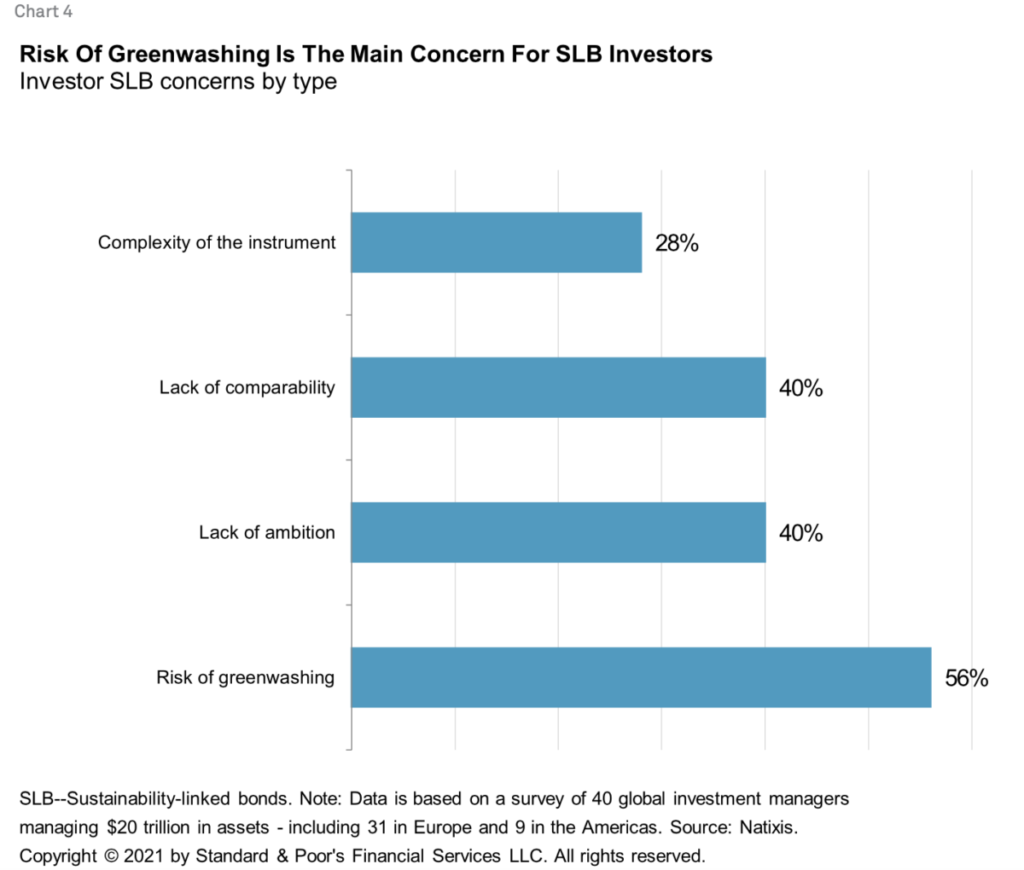

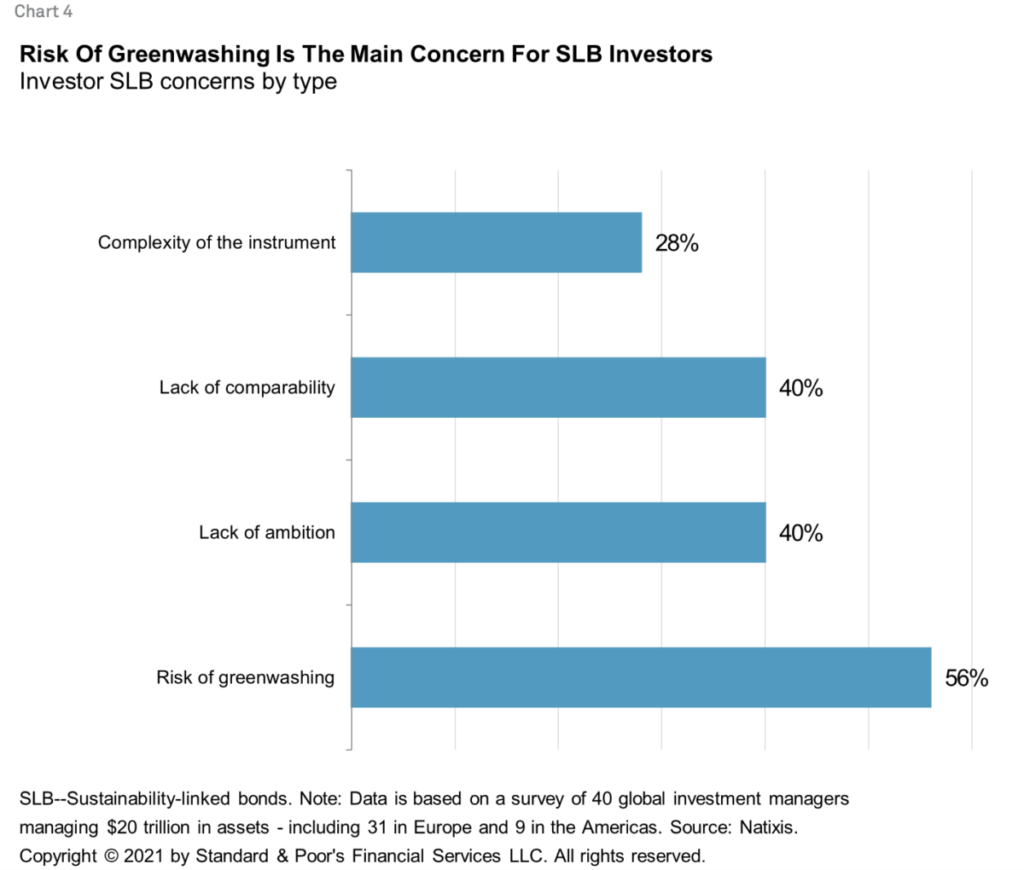

Deloitte is of the view, the regulators, governments, and the industry continue to have serious concerns about “greenwashing.” Risk of greenwashing can unintentionally develop. Insurance companies are particularly vulnerable to the actions of other parties in the value chain without proper governance and supervision.

The insurance sector should be concerned about the environment, but there must be real action taken, not simply “green-washing,” which is when corporate propaganda tricks the public into thinking a company’s products are eco-friendly.

“The industry faces the very real risks of green-washing. This is a very serious issue. Unless the industry comes together to combat false, inflated or misleading claims, we risk losing trust and we cannot afford that as an industry,” Dame Rice.

“We need to make sure that the labels we give our products can stand up to challenge and be understood. Many in the industry might not even know they are green-washing, so we must come together as an industry to stop it.”

In response to the European Supervisory Authorities’ request for information on “greenwashing,” Insurance Europe, the European insurance and reinsurance organization, stated that more time and regulatory clarification are required to address this danger.

In light of the increasing number of businesses making Net Zero commitments, setting goals, and developing “green friendly” products to assist them achieve them, greenwashing has become a major problem for regulators. Greenwashing is now a “material risk,” according to regulators, and companies found to be deceiving clients, investors, and other key stakeholders about the sustainability of their product offerings or transition plans would face supervisory action.

“Trust pertains a lot to reputation, and besides reputation, another key risk is the delay in action,” agreed Dr. Kim Schumacher, Lecturer in Sustainable Finance and ESG, Tokyo Institute of Technology (not a speaker). “Greenwashing leads us to think that something is happening while nothing is happening.”

“This then prevents necessary investments and innovation because we think we already achieved something that in fact only exists on paper.”

“That risk is not only at the corporate level, but also at the sovereign level,” noted Dr. Schumacher.

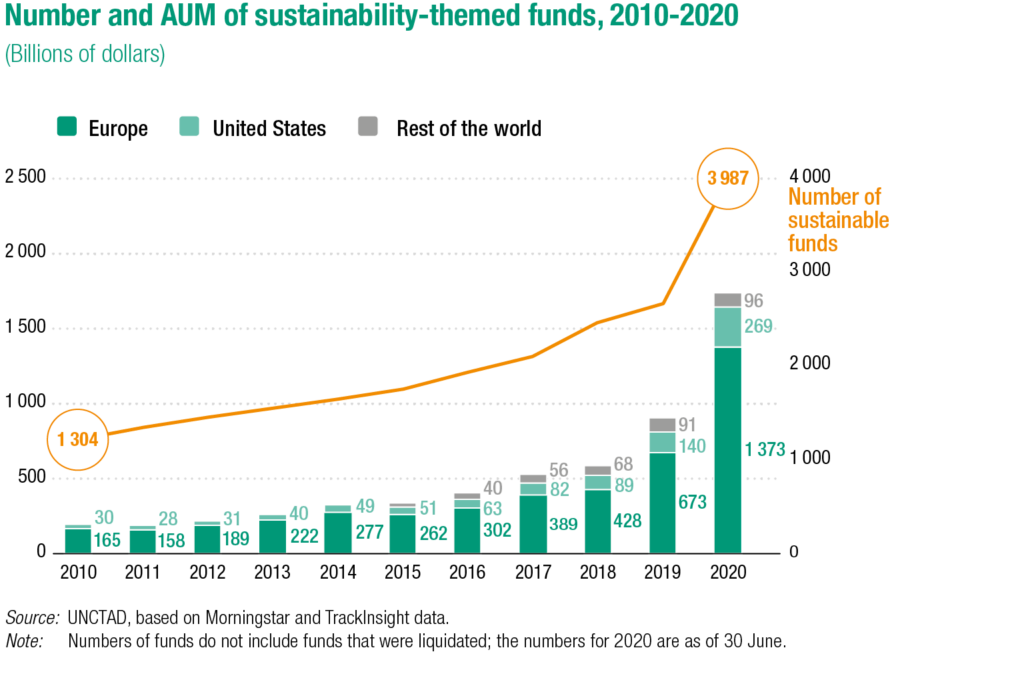

By June 2020, there were 3,987 funds with a sustainability focus, an increase of 30% from the previous year, with almost 50% of all funds having been introduced in the previous five years. Over the previous five years, the AUM of sustainable funds quadrupled; in just the past year alone, it nearly doubled, rising from over $900 billion in 2019 to over $1.7 trillion.

As a result of these delays, a company’s resilience and competitiveness may suffer as its competitors who are actively seeking genuine sustainable innovations gain an advantage and gain sizable market share. This calls for a stricter audit, compliance with heightened needs for cautiousness, integrity and guidance.

Large corporations like BlackRock, United Airlines, Phillips 66, and others are increasingly alerting investors about the dangers posed by increased scrutiny of their claims to be combating climate change.

According to a Bloomberg Law analysis of company filings with the Securities and Exchange Commission, at least 14 S&P 500 members have included “greenwashing” in their 10-K annual reports thus far this year, including the asset manager, airline, and oil refiner, typically as a business risk issue. Only five of the index’s members made mention of it in 10-Ks submitted in 2022.

The majority of discussions were on possible reputational harm, legal issues, and US and international laws regarding greenwashing, or the use of deceptive corporate claims to project an image of environmental responsibility.

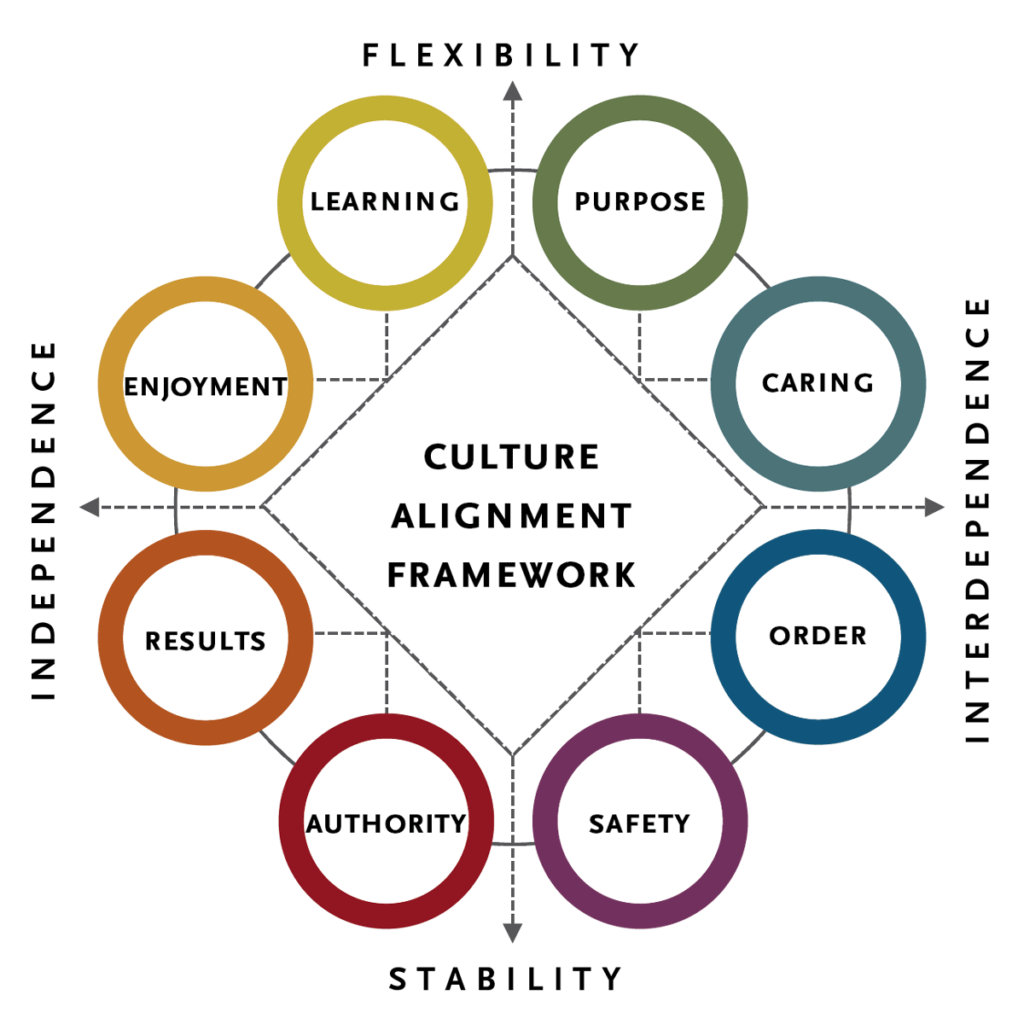

An organization becomes more sustainable and resilient when purpose and culture are incorporated into business strategy and culture. It is also better prepared to handle the complex issues posed by climate change. Organizations and Governments are becoming more and more aware of the transformative impact that a strong culture may have on the implementation of business strategies with incorporated ambitious climate-related goals, particularly those with net-zero ambitions.

The correct organizational culture is essential for combating climate change and acting responsibly, attendees heard. Although Dame Susan Rice acknowledged that it can be challenging for an organization to assess culture, there are several factors that can be measured. As a result, data analytics and behavioural science are now being employed in unique ways to evaluate the culture of financial institutions.

“Culture is sometimes defined as how we behave when no one is looking, but that is not right,” Dame Susan Rice, Chair of the GEFI Global Steering Group commented. ”Culture is about how we behave when everyone is looking.

“Culture reflects what is admired and that is what guides our actions in our organizations. When we consider climate and sustainability, we cannot afford to appear to be achieving our strategy and not actually doing so.”

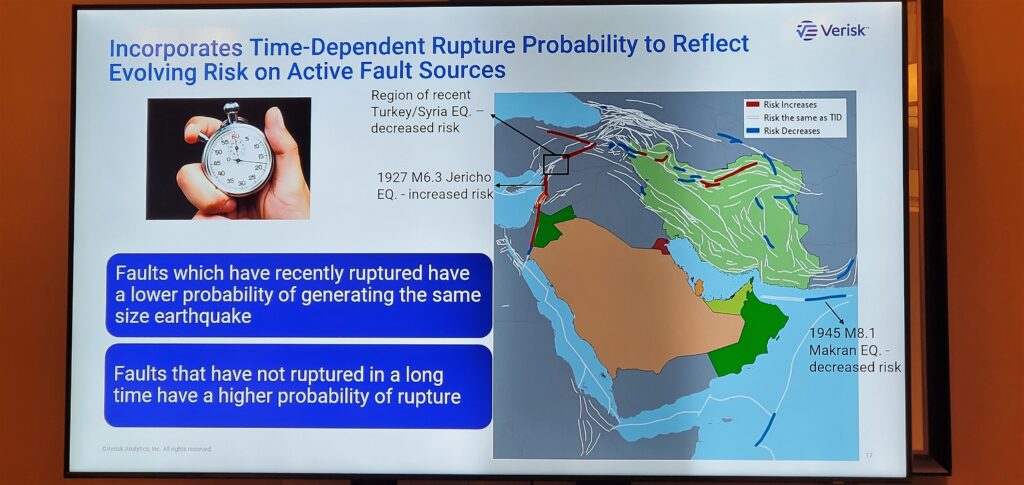

DR. ARASH NASSERI, PHD Senior Principal Engineer, Senior Manager, Verisk presented on THE IMPORTANCE OF EARTHQUAKE CATASTROPHE RISK ASSESSMENT IN THE MIDDLE EAST.

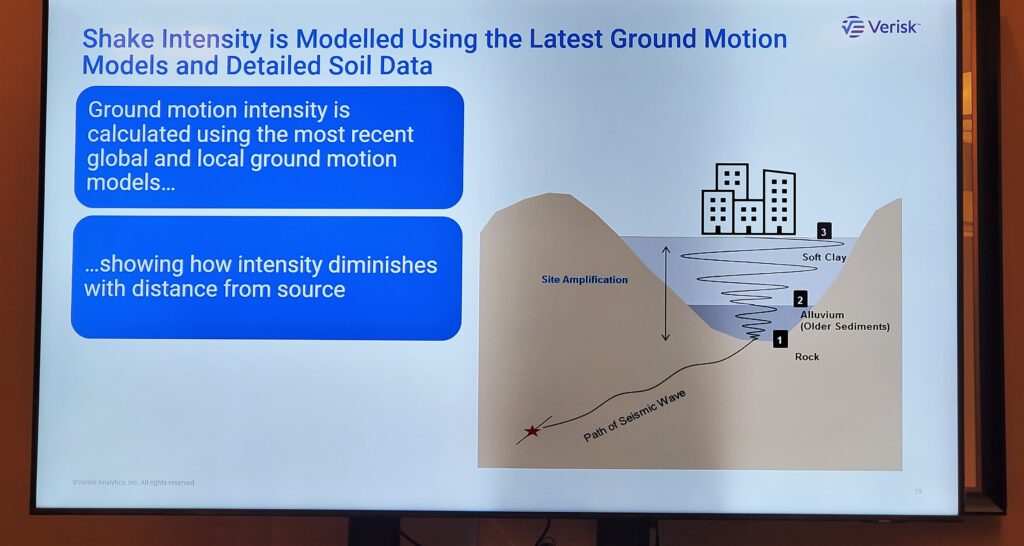

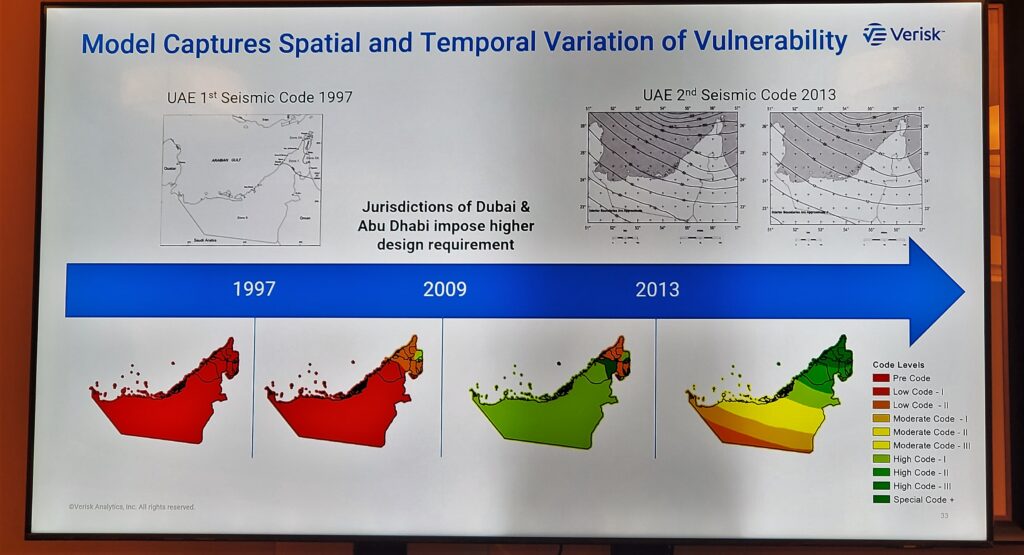

The most reputable and innovative supplier of risk modelling software and consulting services is Extreme Event Solutions, a Verisk company. In 1987, EES established the catastrophe modelling sector. This model includes many hazards such as earth shaking, liquefaction, landslides, fire-following, sprinkler leakage, and tsunami and covers all geographical zones on the planet. The damage estimation component aims to determine how these risks affect society and the built environment in terms of physical damage to assets (buildings and contents), lost productivity (downtime), and casualties and human loss.

Arash Nasseri- Sr. Principal Engineer, Sr. Mgr. at Verisk highlighted about the Turkey earthquake and liquefaction is one of the main factor of the earth caving in, as the triple-junction of the Anatolia, African, and Arabian tectonic plates is close to where the earthquake occurred in Turkey. The earthquake measuring M7.8 on February 6, 2023 struck, was caused by shallow strike-slip faulting, and a second earthquake of magnitude 7.5 struck nine hours after the first M7.8.

Verisk offers expertise and knowledgeable data-driven analytical insights that support the growth, sustainability, and resilience of businesses, individuals, and society. The risk modelling solutions offered by Verisk’s (formerly AIR Worldwide’s) extreme event solutions assist people, organizations, and society in becoming more robust to severe events.

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 72 countries with an approximate population of 3 billion and an estimated GDP of USD 8 trillion. With a close to 20-year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast-growing markets with the economies of Asia, Europe and the Americas through Dubai.